June 10, 2010

SEC puts into place new ‘circuit breaker’ rules to prevent repeat of May 6 stock market plunge

Marcy Gordon, AP Business Writer, On Thursday June 10, 2010, 5:44 pm EDT

WASHINGTON (AP) — Federal regulators on Thursday put in place new rules aimed at preventing a repeat of last month’s harrowing “flash crash” in the stock market.

Members of the Securities and Exchange Commission approved the rules, which call for U.S. stock exchanges to briefly halt trading of some stocks that make big swings.

The major exchanges will start putting the trading breaks into effect as early as Friday for six months. The New York Stock Exchange will begin Friday’s trading session with five stocks: EOG Resources Inc., Genuine Parts Co., Harley Davidson Inc., Ryder System Inc. and Zimmer Holdings Inc. The exchange will gradually add other stocks early next week, expecting to reach by Wednesday the full number that will be covered.

The Nasdaq stock market plans to have the new program fully in place on Monday.

The plan for the “circuit breakers” was worked out by the SEC and the major exchanges following the May 6 market plunge, which saw the Dow Jones industrials lose nearly 1,000 points in less than a half-hour.

Under the new rules, trading of any Standard & Poor’s 500 stock that rises or falls 10 percent or more in a five-minute period will be halted for five minutes. The “circuit breakers” would be applied if the price swing occurs between 9:45 a.m. and 3:35 p.m. Eastern time. That’s almost the entire trading day. But it leaves out the final 25 minutes before the close — a period that often sees raging price swings, especially in recent weeks as the kind of volatility that marked the 2008 financial crisis returned.

The idea is for the trading pause to draw attention to an affected stock, establish a reasonable market price and resume trading “in a fair and orderly fashion,” the SEC said.

On May 6, about 30 stocks listed in the S&P 500 index fell at least 10 percent within five minutes. The drop briefly wiped out $1 trillion in market value as some stocks traded as low as a penny.

The disruption “illustrated a sudden, but temporary, breakdown in the market’s price-setting function when a number of stocks and (exchange-traded funds) were executed at clearly irrational prices,” SEC Chairman Mary Schapiro said in a statement. “By establishing a set of circuit breakers that uniformly pauses trading in a given security across all venues, these new rules will ensure that all markets pause simultaneously and provide time for buyers and sellers to trade at rational prices.”

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, CFTC, circuit breakers, derivatives, efficient-market, equity, Exchange Traded Funds/Notes, financial engineering, FINRA, flash crash, futures, leverage, liquidity, liquidity risk, NYSE, price-setting function, psychology, regulation, risk management, S&P 500, SEC, short ETFs, short-selling, stop-loss, stub quotes | Tagged: comp, eog, gpc, hog, indu, r, spx, zmh |

401k, CFTC, circuit breakers, derivatives, efficient-market, equity, Exchange Traded Funds/Notes, financial engineering, FINRA, flash crash, futures, leverage, liquidity, liquidity risk, NYSE, price-setting function, psychology, regulation, risk management, S&P 500, SEC, short ETFs, short-selling, stop-loss, stub quotes | Tagged: comp, eog, gpc, hog, indu, r, spx, zmh |  Permalink

Permalink

Posted by Jason

Posted by Jason

May 10, 2010

By DONNA KARDOS YESALAVICH And KRISTINA PETERSON

Reuters

Stocks posted their biggest one-day gain in more than a year, boosted by the bailout package to stem Europe’s credit crisis.

The Dow Jones Industrial Average jumped 404.71 points, or 3.9%, to 10785.14, helped by gains in all 30 of its components. The average had its biggest one-day gain in both point and percentage terms since March 23, 2009.

The Standard & Poor’s 500-stock index rose 4.4% to 1159.73, led by its financial and consumer-discretionary sectors, up more than 5% each. All the broad measure’s other indexes posted gains as well.

The jump in U.S. stocks followed rallies in the Asian and European markets after the European Union agreed to a €750 billion ($954.83 billion) bailout, including €440 billion of loans from euro-zone governments., €60 billion from a European Union emergency fund and €250 billion from the International Monetary Fund.

In further coordinated efforts to assuage spooked markets, the European Central Bank will go into the secondary market to buy euro-zone national bonds—a step last week that its president, Jean-Claude Trichet, said the central bank didn’t even contemplate. Meanwhile, the Federal Reserve, working with other central banks, re-activated swap lines so foreign institutions can get access to loans.

“This bailout plan really avoided the worst-case scenario—it avoided contagion and the domino effect,” said Cort Gwon, director of trading strategies of FBN Securities. The package also shifts investors’ attention back to the U.S., where most economic yardsticks have been improving lately, he noted.

The Nasdaq Composite jumped 109.03 points, its first triple-digit point gain since October 2008. It closed at 2374.67, up 4.8%.

Trading volume was higher than the 2010 daily average, though below the frenzied pace of the previous two days, which included an unprecedented “flash crash” and traders’ scramble to square their books after certain trades were canceled. On Monday, composite New York Stock Exchange volume hit 7.1 billion shares, below last week’s peak near 11 billion.

U.S.-listed shares of European banks surged in reaction to the European Union’s bailout plan.

Leave a Comment » |

Leave a Comment » |  asset rotation, bailout, bankruptcy, bear market, bonds, bridge loans, capital, contagion, corporate bonds, deficits, ECB, economy, Federal Reserve, financial engineering, fiscal policy, flash crash, growth, IMF, inflation, liquidity, liquidity risk, NYSE, Obama, risk management, S&P 500, sentiment, socialized risks, swaps, unfunded liabilities | Tagged: comp, indu, spx |

asset rotation, bailout, bankruptcy, bear market, bonds, bridge loans, capital, contagion, corporate bonds, deficits, ECB, economy, Federal Reserve, financial engineering, fiscal policy, flash crash, growth, IMF, inflation, liquidity, liquidity risk, NYSE, Obama, risk management, S&P 500, sentiment, socialized risks, swaps, unfunded liabilities | Tagged: comp, indu, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

August 3, 2009

By Sara Lepro and Tim Paradis, AP Business Writers

Monday August 3, 2009, 6:02 pm EDT

NEW YORK (AP) — The Standard & Poor’s 500 index (SPX) is four digits again now that the stock market’s rally has blown into August.

The widely followed stock market measure broke above 1,000 on Monday for the first time in nine months as reports on manufacturing, construction and banking sent investors more signals that the economy is gathering strength. The S&P is used as a benchmark by professional investors, and it’s also the foundation for mutual funds in many individual 401(k) accounts.

Wall Street’s big indexes all rose more than 1 percent, including the Dow Jones industrial average (INDU), which climbed 115 points.

The market extended its summer rally on the type of news that might have seemed unthinkable when stocks cratered to 12-year lows in early March. A trade group predicted U.S. manufacturing activity will grow next month, the government said construction spending rose in June and Ford Motor Co. (F) said its sales rose last month for the first time in nearly two years.

“The market is beginning to smell economic recovery,” said Howard Ward, portfolio manager of GAMCO Growth Fund. “It may be too early to declare victory, but we are well on our way.”

The day’s reports were the latest indications that the recession that began in December 2007 could be retreating. Better corporate earnings reports and economic data propelled the Dow Jones industrial average 725 points in July to its best month in nearly seven years and restarted spring rally that had stalled in June.

On Monday, a report from the Institute for Supply Management, a trade group of purchasing executives, signaled U.S. manufacturing activity should increase next month for the first time since January 2008 as industrial companies restock shelves. Also, the Commerce Department said construction spending rose rather than fell in June as analysts had expected. The reports and rising commodity prices lifted energy and material stocks.

Ford said sales of light vehicles rose 1.6 percent in July. Other major automakers said they saw signs of stability in sales. Investors predicted that the government’s popular cash for clunkers program would boost overall auto sales to their highest level of the year.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, analysts, asset rotation, bailout, banks, bear market, behavioral science, bonds, buy and hold, capital, China, commodities, copper, crude oil, economy, equity, financials, govt. stats, growth, interest rates, liquidity, mutual fund, real returns, recession, recovery, relative strength, risk management, S&P 500, sentiment, small caps, Treasury bonds, unemployment | Tagged: bcs, cat, comp, f, hsbc, indu, intc, rut, spx, usd |

401k, analysts, asset rotation, bailout, banks, bear market, behavioral science, bonds, buy and hold, capital, China, commodities, copper, crude oil, economy, equity, financials, govt. stats, growth, interest rates, liquidity, mutual fund, real returns, recession, recovery, relative strength, risk management, S&P 500, sentiment, small caps, Treasury bonds, unemployment | Tagged: bcs, cat, comp, f, hsbc, indu, intc, rut, spx, usd |  Permalink

Permalink

Posted by Jason

Posted by Jason

June 16, 2009

The S&P 500 celebrated its great technical accomplishment highlighted in our last note by doing exactly nothing. Maintaining a tight 32 point range from top to bottom, the S&P 500 netted just over 3 points from our previous note to the closing price last Friday, June 12. This week has changed the tune, giving up more than 34 points in just two days. Surrendering initial support in the 925-930 area designated by the May highs, the SPX is once again bearing down on the 200 day moving average, this time from above. Additional support of the 50 day moving average is also moving into the area, just 15.5 points below the 200 day as of today, and rising. The lows from May, which are also the highs from April and February, mark another major support level in the 875-880 range.

Both the MACD and the daily 13/34 exponential moving average indicator have signaled a negative divergence by not confirming the new highs in the price of the average. With the January highs holding as resistance, the head and shoulders bottom we discussed in Still overbought, but over first resistance also is still in play. As we noted, “…finishing the inverse head and shoulders bottom should happen somewhere around the end of June time wise to produce a symmetrical pattern. At this point, it looks like the January highs need to hold as resistance to keep the inverse head and shoulders pattern in play. This is also the approximate level of the 200 day moving average currently and the 200 day stopped the SPX multiple times from 2001-2002, plus twice early in 2003. The first test early in 2003 led to the formation of the right shoulder in the bottoming pattern and the second test required a test of the 50 day moving average as support before breaking out and leaving the 200 day well behind.” With the 50 and 200 day moving averages relatively close together this time, plus the support of the recent lows/previous highs around 875-880, this market has plenty of candidates for a right shoulder not far from current prices. A convincing move back below 875 would signal a deeper correction with targets as low as 741 still completely valid.

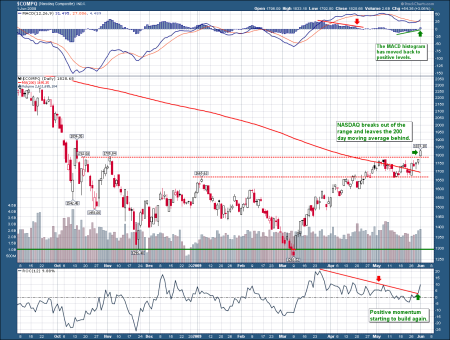

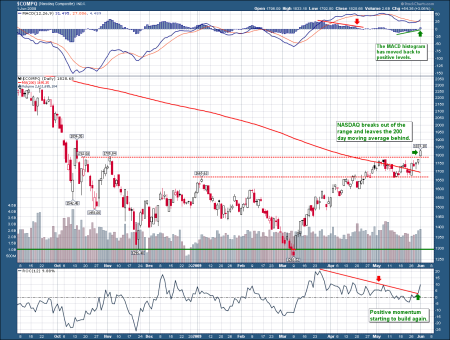

Which brings us to the market leading NASDAQ Composite. Since our last note highlighting the breakout by the COMP, a brief rally has fizzled out with the last two trading days completely erasing the gains and setting up a quick test of the breakout point as support. The rally stopped short of filling the gap opened on the way down in early October 2008, but did manage to bring the 50 and 200 day moving averages into a bullish golden cross. Plenty of support exists for this market, but it doesn’t come into play until 60-120 points below the breakout point at 1785 if the breakout fails to hold. Targets as low as 1500 do not invalidate the uptrend if the SPX makes a run toward the 2002 lows or even 741. The MACD is also showing a negative divergence here by not confirming the new high in price and the ROC shows a failure to build momentum on the breakout.

We are again returning to our short positions, including SH, after precautionary stop outs proved unnecessary and untimely. Our position in SH specifically was re-entered exactly at the stop out price (see Security Growth for details).

Leave a Comment » |

Leave a Comment » |  200 day MA, 50 day MA, asset rotation, bear market, charts, Exchange Traded Funds/Notes, growth, real returns, relative strength, risk management, S&P 500, sentiment, short ETFs, short-selling, tech stocks | Tagged: comp, sh, spx |

200 day MA, 50 day MA, asset rotation, bear market, charts, Exchange Traded Funds/Notes, growth, real returns, relative strength, risk management, S&P 500, sentiment, short ETFs, short-selling, tech stocks | Tagged: comp, sh, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

June 1, 2009

The NASDAQ leads the market higher; leaves the 200 day behind

The S&P 500 accomplished something today, trading above the 200 day simple moving average for the first time in over a year. It was last call in May of 2008 at the 200 day for the SPX before dropping over 50% to the lows of this past March (the SPX hasn’t actually closed above this trend line since late 2007). Today also marks a new high for 2009, some 42% above those March lows in less than three months! Year-to-date the SPX has gained just over 4%.

The NASDAQ is the real star leading the markets higher and breaking free from the recent consolidation range. The NASDAQ is also some 8% above its 200 day simple moving average and almost 10% above the early January highs. Sitting on a year-to-date gain of 16% and almost 45% above the March lows, large cap techs are showing investors’ renewed interest in risk.

At this point, we are exiting the position in SH with a small loss on this renewed strength (see Security Growth for details).

Leave a Comment » |

Leave a Comment » |  200 day MA, asset rotation, bear market, capital, charts, growth, real returns, recession, relative strength, S&P 500, tech stocks | Tagged: comp, sh, spx |

200 day MA, asset rotation, bear market, capital, charts, growth, real returns, recession, relative strength, S&P 500, tech stocks | Tagged: comp, sh, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

May 5, 2009

Another update finds the market shaking off initial profit taking to challenge the highs for the year. Monday’s big push finally left the late January, early February highs behind for the S&P 500 (SPX) after about two weeks of backing and filling to make room for the exit of early profit takers. Volume for this stage of the rally has not been impressive, declining since the large profit taking day in the third week of April. What is impressive, is new buyers have stepped up to continue to push prices higher. Fear of “missing the bottom” is setting in and chasing the rally at this point remains dangerous.

The NASDAQ has been leading the charge, already surpassing the highs for the year to challenge the early November 2008 highs and the 200 day simple moving average. Up more than 39% in less than two months is a remarkable move and building on that through the seasonally weak summer session is going to be difficult. Up days are beating down days by more than 2 to 1 since the bottom, but the pace of gains is decelerating. Volume has remained relatively solid and this change in market leadership posture is notable. Investors have clearly decided to favor more aggressive stocks in this recovery, with the small and mid caps also showing relative strength.

It’s time to break out a chart we were saving for later, as the comparison may be valid already. This is a chart of the bottom formed in the SPX during 2002-2003, after the tech bust. While the bottom itself formed an inverse head and shoulders pattern (which we expect this time also), the recovery from the right shoulder is what really interests us here. Since the drop was not as violent and much more time was worked off with the head and shoulders bottom, the moving averages were not as far above the low prices and were overtaken sooner as a result. But look at the trend that steadily moved up from March to June, before flattening out for the summer, then racing higher again into 2004. It was less than a 30% gain for the first leg up in 2003 from the March low; it’s already 36% for the SPX from the bottom in March this year. While the low was much lower this time, the highs and resistance levels from both years are almost identical. In 2003, the SPX overtook the early January highs around 930 in early May. After a quick, steep drop below 920 to test the breakout, it was off to the races for another straight month, rising over 10% before the June highs. Then it was one test of the inverse head and shoulders neckline in early August at 960 before moving over 1150 by early 2004. This year, the early January highs are in the area of 944 and the SPX is again challenging them in early May. A breakout here followed by a retest of the 920 level could again produce a similar result. The only problem is finishing the inverse head and shoulders bottom, which should happen somewhere around the end of June time wise to produce a symmetrical pattern. At this point, it looks like the January highs need to hold as resistance to keep the inverse head and shoulders pattern in play. This is also the approximate level of the 200 day moving average currently and the 200 day stopped the SPX multiple times from 2001-2002, plus twice early in 2003. The first test early in 2003 led to the formation of the right shoulder in the bottoming pattern and the second test required a test of the 50 day moving average as support before breaking out and leaving the 200 day well behind. Either of those would be a welcomed event for this market to burn off some overbought conditions and excess euphoria. With the VIX at the lowest levels in seven months, purchasing some protection via puts is probably a good idea. We continue to hold and look to add to our position in the ProShares Short S&P 500 ETF (SH) which is about 5% under water now from our first entry. Select longs continue to beat the market averages by a wide margin.

Leave a Comment » |

Leave a Comment » |  200 day MA, 50 day MA, asset rotation, bear market, bubbles, buy and hold, charts, contrarian, equity, Exchange Traded Funds/Notes, growth, mid caps, real returns, relative strength, risk management, S&P 500, sentiment, short ETFs, short-selling, small caps | Tagged: comp, rmc, rut, sh, spx |

200 day MA, 50 day MA, asset rotation, bear market, bubbles, buy and hold, charts, contrarian, equity, Exchange Traded Funds/Notes, growth, mid caps, real returns, relative strength, risk management, S&P 500, sentiment, short ETFs, short-selling, small caps | Tagged: comp, rmc, rut, sh, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

May 4, 2009

by Brett Arends

Monday, May 4, 2009

WSJ.com

Bonds for the long run, anyone?

In the latest issue of the Journal of Indexes, investment manager Rob Arnott, chairman of Research Affiliates (read article here) says that long-term bonds have beaten stocks for decades.

“Starting any time we choose from 1979 through 2008,” Mr Arnott writes, “the investor in 20-year Treasuries (consistently rolling to the nearest 20-year bond and reinvesting income) beats the S&P 500 investor.” He argues the figures are even true going back to the late 1960s.

Mr. Arnott’s article has generated quite a stir in the investment world, where he has, in theory, turned a lot of received wisdom on its head.

But American mutual fund investors, responding to last year’s turmoil, are already voting this way with their wallets. So far this year they’ve withdrawn $45 billion from mutual funds that invest in the stock market, and put $68 billion into bond funds, reports the Investment Company Institute.

Should you follow suit? Not so fast.

Obviously bonds, especially Treasurys, held up well during last year’s crisis. And they can make an important part of a portfolio, especially at the right price. But anyone hoping for a repeat of the last thirty years is probably dreaming.

Treasurys don’t look appealing. Short term bonds yield a miserable 1.9%. And long-term bonds, far from offering “security,” are actually at serious risk from rising inflation.

The past is the past. Those who bought long-term Treasury bonds in the late 1970s and early 1980s simply pocketed an enormous one-off windfall when inflation collapsed. It neared 15% in 1980. Latest figure: -0.4%.

Consider what that means for investors.

In 1979, 20-year Treasurys yielded 9.3%. So over its life the bond paid out $180 in interest for each $100 invested. At one point in 1981, 30-year Treasurys yielded an incredible 15%, thanks to runaway inflation in the 1970s. Investors demanded high interest rates to offset the expected loss of purchasing power on their money.

But when inflation collapsed after 1982, those coupon payments turned golden because the purchasing power stayed high. Bond prices soared in response.

Today, bond investors get no such deal. Ten-year Treasurys pay just 3%. And the 30-year 3.96%.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, analysts, asset rotation, bear market, bonds, bubbles, buy and hold, commodities, compensation, corporate bonds, dividend yield, efficiency, equity, Great Depression, growth, inflation, interest rates, mutual fund, real returns, relative strength, risk management, S&P 500, sentiment, short-selling, Treasury bonds | Tagged: spx |

401k, analysts, asset rotation, bear market, bonds, bubbles, buy and hold, commodities, compensation, corporate bonds, dividend yield, efficiency, equity, Great Depression, growth, inflation, interest rates, mutual fund, real returns, relative strength, risk management, S&P 500, sentiment, short-selling, Treasury bonds | Tagged: spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

April 14, 2009

An update on the SPX chart today to show the market finding resistance near previous highs. We are adding a new indicator to the top of the chart, the MACD. The negative divergence in the MACD histogram reinforces the strength of this resistance as the market advance begins to stall. Finally, we have a short term reversal pattern showing in the candlesticks as an Evening Doji Star has formed over the last 3 trading days. Taken together, it looks as if profit taking may have already started.

The NASDAQ chart shows similar resistance being met at the Jan highs with negative divergences in the MACD histogram and the Rate of Change indicator which is approaching the zero line. Both of these confirm the loss of momentum as the market approaches resistance.

Exactly the opposite looks to be developing in the ProShares Short S&P 500 Fund ETF (SH) as positive divergences are present with the price firming near support. Hedging long exposure here and/or taking profits looks like a good idea. It’s still a bear market rally at this point.

Leave a Comment » |

Leave a Comment » |  200 day MA, 50 day MA, asset rotation, bear market, buy and hold, capital, cash out, charts, contrarian, equity, Exchange Traded Funds/Notes, growth, real returns, relative strength, risk management, S&P 500, short ETFs | Tagged: comp, sh, spx |

200 day MA, 50 day MA, asset rotation, bear market, buy and hold, capital, cash out, charts, contrarian, equity, Exchange Traded Funds/Notes, growth, real returns, relative strength, risk management, S&P 500, short ETFs | Tagged: comp, sh, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

April 2, 2009

We have a lot to show, so we’ll keep each one short and sweet.

First, an update on the SPX battle with the 50 day. The bear trap looks to be pretty solid with assistance from the Feds. How much backing and filling needs done is still up for debate. We have added a new indicator to the bottom of the chart this time, the daily 13/34 exponential moving average indicator. We have it set on a favorite parameter of John Murphy at Stockcharts.com that we have referenced previously in Is it really 2001 again? Look for further reference in the charts below. This indicator on the daily chart is more of a leading indicator (subject to some whipsaw) and becomes more valuable when combined with the medium and long period charts. The daily indicator has turned positive (above zero) and has held positive ground for the first time since early in the year. This is the most positive showing for this indicator since April/May of 2008.

Here is a weekly shot of the same indicator. Even with this indicator still deeply in negative territory (below zero) a clear positive trend change is visible. This is confirmed by the SPX moving above the 13 week exponential moving average, which drags the indicator higher. These are also the first positive developments in this indicator since April/May of 2008.

Finally we have the monthly chart featuring the indicators referenced previously (MACD, RSI, ROC) plus an overlay of the 20 month Bollinger Bands set to two standard deviations. This shows all of these indicators to have been severely stretched, yet showing signs of recovery. The MACD histogram is now climbing for two months in a row and the RSI is closing in on 30, which marks the top of oversold territory. The ROC has at least ceased its vertical drop and the Bollinger Bands are finally well below the current price as opposed to being violently penetrated to the downside. This at least shows stabilization, with potential being revealed by the shorter periods.

Leave a Comment » |

Leave a Comment » |  200 day MA, 50 day MA, asset rotation, bear market, buy and hold, capital, charts, economy, equity, fair value accounting, Federal Reserve, fiscal policy, growth, lending standards, liquidity, marked to market, real returns, recession, regulation, relative strength, risk management, S&P 500, SEC, sentiment | Tagged: spx |

200 day MA, 50 day MA, asset rotation, bear market, buy and hold, capital, charts, economy, equity, fair value accounting, Federal Reserve, fiscal policy, growth, lending standards, liquidity, marked to market, real returns, recession, regulation, relative strength, risk management, S&P 500, SEC, sentiment | Tagged: spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

March 30, 2009

The SPX only stayed above the 50 day simple moving average this time for 5 days. At the turn of the year, it at least managed 7. The 2002 lows are crucial support to test the will of new buyers. If they fail to hold, the 741 level will serve as the canary to warn of a possible complete retest of the March lows.

So far, we have only another headfake to the upside created by jawboning from the Feds. We still believe this is part of a bottoming process, but we need more honest buying (not short covering) to confirm the lows are already in.

Leave a Comment » |

Leave a Comment » |  401k, 50 day MA, asset rotation, bear market, capital, charts, demographics, drawdown, economy, equity, Federal Reserve, growth, real returns, recession, relative strength, risk management, S&P 500, sentiment | Tagged: spx |

401k, 50 day MA, asset rotation, bear market, capital, charts, demographics, drawdown, economy, equity, Federal Reserve, growth, real returns, recession, relative strength, risk management, S&P 500, sentiment | Tagged: spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

March 28, 2009

By JASON ZWEIG

wsj.com

A power struggle in Washington will shape how investors get the advice they need.

On one side are stockbrokers and other securities salespeople who work for Wall Street firms, banks and insurance companies. On the other are financial planners or investment advisers who often work for themselves or smaller firms.

Brokers are largely regulated by the Financial Industry Regulatory Authority, which is funded by the brokerage business itself and inspects firms every one or two years. Under Finra’s rules, brokers must recommend only investments that are “suitable” for clients.

Advisers are regulated by the states or the Securities and Exchange Commission, which examines firms every six to 10 years on average. Advisers act out of “fiduciary duty,” or the obligation to put their clients’ interests first.

Most investors don’t understand this key distinction. A report by Rand Corp. last year found that 63% of investors think brokers are legally required to act in the best interest of the client; 70% believe that brokers must disclose any conflicts of interest. Advisers always have those duties, but brokers often don’t. The confusion is understandable, because a lot of stock brokers these days call themselves financial planners.

Brokers can sell you any investment they have “reasonable grounds for believing” is suitable for you. Only since 1990 have they been required to base that suitability judgment on your risk tolerance, investing objectives, tax status and financial position.

A key factor still is missing from Finra’s suitability requirements: cost. Let’s say you tell your broker that you want to simplify your stock portfolio into an index fund. He then tells you that his firm manages an S&P-500 Index fund that is “suitable’ for you. He is under no obligation to tell you that the annual expenses that his firm charges on the fund are 10 times higher than an essentially identical fund from Vanguard. An adviser acting under fiduciary duty would have to disclose the conflict of interest and tell you that cheaper alternatives are available.

If brokers had to take cost and conflicts of interest into account in order to honor a fiduciary duty to their clients, their firms might hesitate before producing the kind of garbage that has blighted the portfolios of investors over the years.

Richard G. Ketchum, chairman of Finra, has begun openly using the F-word: fiduciary. “It’s time to get to one standard, a fiduciary standard that works for both broker-dealers and advisers,” he told me. “Both should have a fundamental first responsibility to their customers.”

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, analysts, asset rotation, bailout, bank failure, bankruptcy, banks, bear market, bubbles, buy and hold, capital, compensation, contrarian, demographics, drawdown, efficiency, entitlement, equity, Exchange Traded Funds/Notes, financial adviser, financial literacy, financials, growth, leverage, mutual fund, optimization, organic, ratings, real returns, recession, regulation, relative strength, risk management, S&P 500, SEC | Tagged: spx |

401k, analysts, asset rotation, bailout, bank failure, bankruptcy, banks, bear market, bubbles, buy and hold, capital, compensation, contrarian, demographics, drawdown, efficiency, entitlement, equity, Exchange Traded Funds/Notes, financial adviser, financial literacy, financials, growth, leverage, mutual fund, optimization, organic, ratings, real returns, recession, regulation, relative strength, risk management, S&P 500, SEC | Tagged: spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

March 25, 2009

“It’s déjà vu all over again.”

– Yogi Berra

In mid-December, after the Fed lowered rates to 0 to .25%, we noted:

Aggressive action by the Federal Reserve today pushed most markets above their respective simple 50 day moving averages for the first time since September. We have highlighted the 50 day as resistance level number one in prior notes and have shown it to be critical resistance along with the 200 day and 80 week. This is a primary step to recovery and opens the door to a potential challenge of the 200 day near the beginning of 2009.

That rally was short lived, eventually failing after a more sustained move above the 50 day near the beginning of the year. What is interesting is that we may be seeing a similar sequence of events again.

After a brief dip below the 2002 lows, the SPX has rallied back significantly on the back of announcements from the Treasury and Federal Reserve. The combination of these announcements (along with better economic reports) has again pushed most major market averages over their simple 50 day moving averages. Unfortunately, volume has not expanded with this push, even though volume levels are higher than earlier in the year.

The market managed about 7 days above the 50 day in early January. So far, we have 3 days on this trip. To avoid a repeat of action earlier in the year, it is critical that the SPX remain above the 50 day and the 2002 lows. The Feds can do all of the grandstanding and wagon circling they want, but the market will not be forced higher. We need to see organic buying build on this foundation for the bears to truly remain buried below the 2002 lows. Ideally, a high volume rally will spring from support at the 50 day to challenge the Feb highs in the area of 875. If this occurs, the 50 day and 800 will serve as very solid support going forward as we move toward the Jan highs around 940.

If the market again fails after a quick Fed induced burst over the 50 day, we look at 741 as the first support level below the 2002 lows. A significant break at 741 would argue for at least a retest of the lows at 667. With other indicators showing improvement, including some leaders exhibiting notable relative strength, it is our assumption at this point that the lows at 667 will not be broken.

2 Comments |

2 Comments |  200 day MA, 401k, 50 day MA, 80 week MA, analysts, asset rotation, bailout, banks, bear market, buy and hold, capital, charts, economy, equity, Federal Reserve, growth, relative strength, risk management, S&P 500, sentiment | Tagged: spx |

200 day MA, 401k, 50 day MA, 80 week MA, analysts, asset rotation, bailout, banks, bear market, buy and hold, capital, charts, economy, equity, Federal Reserve, growth, relative strength, risk management, S&P 500, sentiment | Tagged: spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

March 18, 2009

Here we show a nice relationship between the VIX and the SPX. While this is a commonly referenced pairing, many still challenge the value of using the VIX as a market indicator. There are numerous ways too use the VIX and almost everyone has their own tweaks. This chart shows a very clear inverse relationship with several distinct “phases” discernible in the value of the VIX. These “phases” correlate well with the action in the SPX. We have labled these phases “euphoria”, “fear” and “panic”. We also included the 400 day moving average (equivalent to the 80 week) which we discussed previously in The Significance of the 400 day (80 week) moving average. This bull/bear market reference point matches up very well with the action in the VIX, as the VIX moves into the “fear phase” just as the 400 day is coming under assault, before eventually breaking. A final test of the 400 day from below, which we highlighted in late April 2008, was accompanied by one last dip into the “euphoria” zone for the VIX. That was the “last chance” to get out before the drop gathered steam as the SPX then dropped over 50% in less than 12 months.

We added the notes on Bear Stearns and Citigroup for a consensus of the “expert” opinion at the time.

Leave a Comment » |

Leave a Comment » |  401k, 80 week MA, analysts, asset rotation, bailout, bank failure, banks, bear market, bubbles, buy and hold, capital, cash out, charts, compensation, debt-ceiling, derivatives, drawdown, economy, efficiency, election, entitlement, equity, Exchange Traded Funds/Notes, fair value accounting, Federal Reserve, financial adviser, financial literacy, financials, foreclosure, GDP, Great Depression, growth, housing, interest rates, lawsuits, lending standards, level 1 assets, level 2 assets, level 3 assets, leverage, liquidity, loan to value, marked to market, MBS, mortgages, preferred, ratings, real returns, recession, regulation, relative strength, risk management, S&P 500, sentiment, short ETFs, short-selling, subprime, writedowns | Tagged: bsc, c, spx, vix |

401k, 80 week MA, analysts, asset rotation, bailout, bank failure, banks, bear market, bubbles, buy and hold, capital, cash out, charts, compensation, debt-ceiling, derivatives, drawdown, economy, efficiency, election, entitlement, equity, Exchange Traded Funds/Notes, fair value accounting, Federal Reserve, financial adviser, financial literacy, financials, foreclosure, GDP, Great Depression, growth, housing, interest rates, lawsuits, lending standards, level 1 assets, level 2 assets, level 3 assets, leverage, liquidity, loan to value, marked to market, MBS, mortgages, preferred, ratings, real returns, recession, regulation, relative strength, risk management, S&P 500, sentiment, short ETFs, short-selling, subprime, writedowns | Tagged: bsc, c, spx, vix |  Permalink

Permalink

Posted by Jason

Posted by Jason

January 28, 2009

By Robert Schmidt and Alison Vekshin

Jan. 28 (Bloomberg) — The Obama administration is moving closer to setting up a so-called bad bank in its effort to break the back of the credit crisis and may use the Federal Deposit Insurance Corp. to manage it, two people familiar with the matter said.

U.S. stocks gained, extending a global rally, on optimism the bad-bank plan will help shore up the economy. The Standard & Poor’s 500 Stock Index (SPX) rose 3.1 percent to 871.70 at 2:40 p.m. in New York. Bank of America Corp. (BAC), down 54 percent this year before today, rose 84 cents, or 13 percent, to $7.34. Citigroup Inc. (C), which had fallen 47 percent this year, climbed 17 percent.

FDIC Chairman Sheila Bair is pushing to run the operation, which would buy the toxic assets clogging banks’ balance sheets, one of the people said. Bair is arguing that her agency has expertise and could help finance the effort by issuing bonds guaranteed by the FDIC, a second person said. President Barack Obama’s team may announce the outlines of its financial-rescue plan as early as next week, an administration official said.

“It doesn’t make sense to give the authority to anybody else but the FDIC,” said John Douglas, a former general counsel at the agency who now is a partner in Atlanta at the law firm Paul, Hastings, Janofsky & Walker. “That’s what the FDIC does, it takes bad assets out of banks and manages and sells them.”

Bank Management

The bad-bank initiative may allow the government to rewrite some of the mortgages that underpin banks’ bad debt, in the hopes of stemming a crisis that has stripped more than 1.3 million Americans of their homes. Some lenders may be taken over by regulators and some management teams could be ousted as the government seeks to provide a shield to taxpayers.

Bank seizures are “going to happen,” Senator Bob Corker, a Tennessee Republican, said in an interview after a meeting between Obama and Republican lawmakers in Washington yesterday. “I know it. They know it. The banks know it.”

Laura Tyson, an adviser to Obama during his campaign, said banks need to be recapitalized “with different management” so they start lending again. “You find some new sophisticated management unlike the failed management of the past,” Tyson, a University of California, Berkeley, professor, said today at the World Economic Forum conference in Davos, Switzerland.

Still, nationalization of a swath of the banking industry is unlikely. House Financial Services Chairman Barney Frank said yesterday “the government should not take over all the banks.” Bair said earlier this month she would be “very surprised if that happened.”

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, analysts, asset rotation, bailout, bank failure, bankruptcy, banks, bear market, bonds, bridge loans, buy and hold, capital, civil penalties, compensation, corporate bonds, debt-ceiling, demographics, derivatives, entitlement, equity, fair value accounting, FDIC, federal budget, Federal Reserve, financials, fiscal policy, foreclosure, GDP, govt. stats, growth, housing, income tax, inflation, interest rates, Japan, lending standards, leverage, liquidity, marked to market, MBS, mortgages, Obama, preferred, president, recession, regional banks, regulation, risk management, S&P 500, sentiment, subprime, Treasury bonds, unemployment, unfunded liabilities | Tagged: aig, bac, bsc, c, imb, spx |

401k, analysts, asset rotation, bailout, bank failure, bankruptcy, banks, bear market, bonds, bridge loans, buy and hold, capital, civil penalties, compensation, corporate bonds, debt-ceiling, demographics, derivatives, entitlement, equity, fair value accounting, FDIC, federal budget, Federal Reserve, financials, fiscal policy, foreclosure, GDP, govt. stats, growth, housing, income tax, inflation, interest rates, Japan, lending standards, leverage, liquidity, marked to market, MBS, mortgages, Obama, preferred, president, recession, regional banks, regulation, risk management, S&P 500, sentiment, subprime, Treasury bonds, unemployment, unfunded liabilities | Tagged: aig, bac, bsc, c, imb, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

December 24, 2008

S&P’s chief investment strategist says a bear-market bottom may already be in place—and tells why 2009 could be a better year for stocks

By Sam Stovall From Standard & Poor’s Equity Research Investing

Excerpted from a report published by Standard & Poor’s Equity Research Services on Dec. 22

Investors will remember 2008 as a year of change. Not just change in the White House, but also the pocket change that they used to call their portfolios.

Let’s face it. This bear market started as the perfect storm of popping bubbles—commodities, emerging markets, hedge funds, and real estate. From Oct. 9, 2007 through Nov. 20, 2008, the S&P 500 (SPX) declined 52%, making it the third-worst bear market since the 1929-32 crash. One of the more amazing characteristics of this decline was its speed. The average “mega-meltdown,” or bear market decline of more than 40%, traditionally took 21 months to play out. This one took 13 months.

Not surprisingly, all 10 sectors within the “500” fell, from a 22% slump for Consumer Staples to a 74% thrashing for the Financials. Finally, 125 of the 128 subindustries in the S&P 500 declined.

Factors Backing a Bottom

Where do we go from here? Probably not lower, in our opinion. A few months ago, I wrote that 700 on the “500” might be a worst-case scenario for a decline, citing the trendline drawn off of the 1932 low, the average bear-market retracement of prior bull market advances, and the applying of a bear market P/E ratio on a conservative “top-down” EPS estimate. We got close to that level, as the S&P 500 closed at 752 on Nov. 20. Since then, it rose 21%—technically signaling the start of a new bull market. So I say why quibble? What’s 50 points among friends? Besides, we believe there are several reasons that a bear-market bottom may already be in place.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, 50% Retrace, analysts, asset rotation, bear market, buy and hold, charts, commodities, dividend yield, drawdown, economy, equity, relative strength, risk management, S&P 500, sentiment | Tagged: spx |

401k, 50% Retrace, analysts, asset rotation, bear market, buy and hold, charts, commodities, dividend yield, drawdown, economy, equity, relative strength, risk management, S&P 500, sentiment | Tagged: spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

December 16, 2008

Aggressive action by the Federal Reserve today pushed most markets above their respective simple 50 day moving averages for the first time since September. We have highlighted the 50 day as resistance level number one in prior notes and have shown it to be critical resistance along with the 200 day and 80 week. This is a primary step to recovery and opens the door to a potential challenge of the 200 day near the beginning of 2009.

A rally to the 200 day would be quite significant as the recent violent plunge has opened up a large gap over the 50 day. A similar test of the 200 day as resistance came in early 2002, though the gap was not as dramatic, because the market did not fall to such lows as quickly as this year.

See the charts for the major averages below, with the 50 day moving average in blue and the 200 day in red:

Leave a Comment » |

Leave a Comment » |  200 day MA, 50 day MA, 80 week MA, asset rotation, bear market, buy and hold, charts, equity, Federal Reserve, relative strength, S&P 500, sentiment | Tagged: comp, indu, nya, spx |

200 day MA, 50 day MA, 80 week MA, asset rotation, bear market, buy and hold, charts, equity, Federal Reserve, relative strength, S&P 500, sentiment | Tagged: comp, indu, nya, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

December 8, 2008

Fri Dec 5, 2008 3:29pm EST

By John Parry and Jennifer Ablan

NEW YORK (Reuters) – U.S. government debt, long considered the safest investment in the world, looks like it too has been hit by “bubble” fever.

Prices of U.S. Treasury bonds appear dangerously overstretched after a soaring rally, another sign of how financial markets have been turned on their head.

“Treasuries are the riskiest securities on the planet,” said Tom Sowanick, chief investment officer for $22 billion in assets at Clearbrook Financial LLC in Princeton, New Jersey.

While few fear that the U.S. government will fail to honor its debts, many see a risk that bond prices may plunge just as spectacularly as house, commodity and stock prices have in recent months.

“It looks like the Treasury market is in bubble territory,” said William Larkin, fixed-income portfolio manager with Cabot Money Management, in Salem, Massachusetts.

The rally in the nearly $5 trillion U.S. government bond market picked up speed this week when the Federal Reserve hinted it may buy longer maturity government bonds.

Fears of a bubble in Treasuries underscore how far investors have fled from risk since ballooning house price valuations popped in 2007, causing huge losses in markets across the board and sparking a global economic crisis.

Yields on long-maturing bonds are below 3 percent and only 1-2 basis points on three-month T-bills, the lowest in decades.

After buying billions of dollars worth of government debt, U.S. institutional investors and foreigners including Asian central banks could incur enormous capital losses.

Read the rest of this entry »

2 Comments |

2 Comments |  401k, analysts, asset rotation, bailout, banks, bear market, bonds, bubbles, buy and hold, capital, cash out, commercial paper, corporate bonds, derivatives, dividend yield, economy, equity, Exchange Traded Funds/Notes, FDIC, federal budget, Federal Reserve, fiscal policy, foreclosure, govt. stats, growth, housing, inflation, infrastructure, interest rates, liquidity, MBS, mortgages, preferred, recession, risk management, S&P 500, sentiment, short-selling, Treasury bonds | Tagged: spx |

401k, analysts, asset rotation, bailout, banks, bear market, bonds, bubbles, buy and hold, capital, cash out, commercial paper, corporate bonds, derivatives, dividend yield, economy, equity, Exchange Traded Funds/Notes, FDIC, federal budget, Federal Reserve, fiscal policy, foreclosure, govt. stats, growth, housing, inflation, infrastructure, interest rates, liquidity, MBS, mortgages, preferred, recession, risk management, S&P 500, sentiment, short-selling, Treasury bonds | Tagged: spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

November 20, 2008

The 2002 lows are under assault and this drop so far makes that one look like child’s play. All long term indicators are more negative now than at any point in the 2000-2002 bear.

Leave a Comment » |

Leave a Comment » |  bear market, buy and hold, capital, charts, drawdown, economy, equity, growth, recession, risk management, S&P 500 | Tagged: spx |

bear market, buy and hold, capital, charts, drawdown, economy, equity, growth, recession, risk management, S&P 500 | Tagged: spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

November 13, 2008

So far the trading range is still holding up. Quite a sharp bounce from these levels once again.

The S&P 500 actually broke the lows today before rocketing back.

Leave a Comment » |

Leave a Comment » |  asset rotation, bear market, buy and hold, charts, equity, relative strength, risk management, S&P 500 | Tagged: indu, spx |

asset rotation, bear market, buy and hold, charts, equity, relative strength, risk management, S&P 500 | Tagged: indu, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

October 30, 2008

Time for another chapter in the saga of capital destruction we call the stock market.

Just in time for the negative GDP number everyone has been waiting for, the market is finding a bottom. It may not be the ultimate bear market bottom, but it’s probably the bottom for 2008. As we noted in We’re sure scared now…bringing it all together, “Historically, a retest of the lows develops within a few months to verify the strength of the bottom. Hitting the exact lows again is not a necessity, but a second significant down move usually at least comes close. This offers a great time to pick up relative strength leaders as they separate from the pack.”

We have seen not only one, but two tests of the lows since that writing, in the broad market indices. Neither one of those tests completely reached the initial low, but both were violent and low enough to be considered valid. The updated chart of the Dow Jones Industrial Average shows pullbacks of 1,500 and 1,100 points respectively, with both lows about 300 points above the initial low of October 10.

What has developed now is a trading range. Not exactly bullish, but much better than the ski slope drop of the last few months, October in particular. Seasonality is also about to turn positive as the November through April time period is historically the best six months of the year for the markets. November itself is one of the best single months to be invested.

So how do we decide what to do?

There are several options here really. Trading range strategies are particularly profitable in times of high volatility. Selling premium and initiating spreads are some preferred options trading strategies for this kind of market environment. For long term investors, picking up relative strength leaders near the lows is a great strategy. Many stocks have been unfairly punished and are now wildly undervalued. For indexers or 401k investors that have protected their assets with bond funds and stable value funds and cash, start moving it back in on these bad days as long as the lows hold. For aggressive traders, we know there are some serious mean reversion trades already started.

What we must all keep in mind is that we do not know if the lows will hold or not. As long as they do, buy them but don’t commit all of your capital at once. Take little bites and dollar cost average into positions, especially if you are not trading. There are many great opportunities here, but there will be many in the future also. Don’t let yourself get stopped or margined out (heaven forbid) when you should be buying more. The amount of forced liquidation by hedge funds is not something that is knowable by anyone. It is creating great prices, but it could carry much further if the selling continues to feed upon itself. If the trading range is broken to the upside we would become more bullish and would start to look at the 50 day, 200 day and 80 week moving averages as resistance. Another bullish clue we are looking for is for volatility to drop, specifically the $VIX needs to drop under the 20 day moving average which has provided support since the breakout in early September.

Leave a Comment » |

Leave a Comment » |  200 day MA, 401k, 80 week MA, asset rotation, bear market, bonds, buy and hold, capital, charts, equity, Exchange Traded Funds/Notes, relative strength, risk management, S&P 500, sentiment | Tagged: indu, spx, vix |

200 day MA, 401k, 80 week MA, asset rotation, bear market, bonds, buy and hold, capital, charts, equity, Exchange Traded Funds/Notes, relative strength, risk management, S&P 500, sentiment | Tagged: indu, spx, vix |  Permalink

Permalink

Posted by Jason

Posted by Jason

October 14, 2008

A historic level of fear, even panic, has developed as forced liquidation is removing some players from the market completely. Another difficult lesson in leverage and risk management for some really bright folks. Brings to mind one of my favorite quotes, compliments of John Maynard Keynes, “The market can stay irrational longer than you can stay solvent”.

Irrational may be a mild description for what we’re seeing in the markets currently. After a 1,000 point range on Friday from top to bottom, the Dow Jones Industrial Average added almost another 1,000 points Monday. Clearly the selling was overdone on the downside and the market was drastically oversold after a 3,000 point decline from top to bottom in the previous eight trading sessions. Thankfully, those nasty shorts decided to take some profits and get the rebound started Friday morning.

Irrational may be a mild description for what we’re seeing in the markets currently. After a 1,000 point range on Friday from top to bottom, the Dow Jones Industrial Average added almost another 1,000 points Monday. Clearly the selling was overdone on the downside and the market was drastically oversold after a 3,000 point decline from top to bottom in the previous eight trading sessions. Thankfully, those nasty shorts decided to take some profits and get the rebound started Friday morning.

We wouldn’t consider this the all clear signal however. Historically, a retest of the lows develops within a few months to verify the strength of the bottom. Hitting the exact lows again is not a necessity, but a second significant down move usually at least comes close. This offers a great time to pick up relative strength leaders as they separate from the pack.

The correlation noted in Here we are again? 2001 vs. 2008, Is it really 2001 again? and Back to the future again and it’s not pretty has finally culminated in the fear based washout we have been looking for. Admittedly, it was at much lower levels than we expected, but the timing was almost perfect. The rebound in 2001 started on the morning of Friday, September 21 at 944.75 on the Standard & Poor’s 500 (SPX). The rally continued on Monday and Tuesday of the next week, covering a respectable 75.54 points or 8% from the lows. Another 20 points were added by the close of the week after a brief rest on Wednesday and Thursday. By the end of the following week, another 30 points had been added (for a total of 126.63 points or 13.4%, from the lows). Two weeks later, the net gain was flat after a brief run over 1,107. Sideways trading then developed until a clear break over 1,100 in the first week of November. Around Thanksgiving, the new high of 1,163 had brought the market back from the lows by over 23%. The rest of the year saw a peak gain of only 10 more points in the first week of December. A final 3.5 points was all that was left for the first week of the new year, as an intermediate top at 1,176.97 was found. That top was tested again in late March of 2002, after a 100 point (8.7%) drop into late February. That was all she wrote for that bounce however, as the SPX found new lows at 768 in October, finally the low for the entire bear market. Patient buyers were rewarded as the final retest of the lows completed a massive head and shoulders bottom in March of 2003 at 789.

By the end of the following week, another 30 points had been added (for a total of 126.63 points or 13.4%, from the lows). Two weeks later, the net gain was flat after a brief run over 1,107. Sideways trading then developed until a clear break over 1,100 in the first week of November. Around Thanksgiving, the new high of 1,163 had brought the market back from the lows by over 23%. The rest of the year saw a peak gain of only 10 more points in the first week of December. A final 3.5 points was all that was left for the first week of the new year, as an intermediate top at 1,176.97 was found. That top was tested again in late March of 2002, after a 100 point (8.7%) drop into late February. That was all she wrote for that bounce however, as the SPX found new lows at 768 in October, finally the low for the entire bear market. Patient buyers were rewarded as the final retest of the lows completed a massive head and shoulders bottom in March of 2003 at 789.

In 2008, the rebound started on the morning of Friday, October 10 at 839.80 on the SPX, almost three weeks behind schedule. So far, the monster rally of Monday, October 13 has added 167.13 points or 19.9% from the lows. A morning look at the futures market suggests another 20 or so points may be in the works for Tuesday. In just three trading days, this bounce has covered almost the entire distance of the rebound in 2001-02, on a percentage basis. The preceding decline was also much more violent as the SPX dropped from 1,300 to the lows at 839.80 (35.4%) in just six weeks. In 2001, the fall drop was 28.2% over 16 weeks.

What Does it All Mean

If history holds, only a small portion of this bounce is behind us and there will be plenty of opportunities to get in at decent prices. The first leg of this rally is past, but the second leg could be just as profitable. At the very least, consolidation will develop following these monster gains. This will give nimble traders the ability to buy the dips. Long term investors are almost guaranteed to get another chance at prices near the lows in the coming months. The key is to watch overhead resistance, and there is a ton of it. Fibonacci retracements, moving averages and previous lows all will take their bite from the rally. Don’t forget The Significance of the 400 day (80 week) moving average indicates we are still in a bear market. No other long term indicators have given buy signals either.

One more market comparison to consider is the crash of 1987 which found its low on Tuesday, October 20. This price action may actually be more appropriate considering the violence of the decline. This October “crash” market dropped 35.9% in 8 weeks, bounced 19.8% in two days, then dropped back to within a few percentage points of the low in early December. The market then totally recovered within two years.

One more market comparison to consider is the crash of 1987 which found its low on Tuesday, October 20. This price action may actually be more appropriate considering the violence of the decline. This October “crash” market dropped 35.9% in 8 weeks, bounced 19.8% in two days, then dropped back to within a few percentage points of the low in early December. The market then totally recovered within two years.

Leave a Comment » |

Leave a Comment » |  200 day MA, 50% Retrace, 80 week MA, asset rotation, bear market, buy and hold, capital, charts, equity, futures, relative strength, risk management, S&P 500, sentiment | Tagged: indu, spx |

200 day MA, 50% Retrace, 80 week MA, asset rotation, bear market, buy and hold, capital, charts, equity, futures, relative strength, risk management, S&P 500, sentiment | Tagged: indu, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

October 6, 2008

Monday October 6, 8:26 pm ET

By Joe Bel Bruno and Tim Paradis, AP Business Writers

Despite big afternoon rally, Wall Street finishes below 10,000 for first time since 2004

NEW YORK (AP) — Wall Street joined in a worldwide cascade of despair Monday over the financial crisis, driving the Dow Jones industrials to their biggest loss ever during a trading day. Even a big afternoon rally failed to keep the Dow from its first close below 10,000 since 2004.

The sell-off came despite the $700 billion U.S. government bailout package, which was signed into law Friday after two weeks in which traders had appeared to count on the rescue as their only hope to avoid a market meltdown.

At its worst point, the Dow was down more than 800 points, an intraday record. The stock market rallied during the final 90 minutes of the trading day, and the Dow finished down about 370 points at 9,955.50.

The average is down almost 30 percent from its all-time high of 14,164.53, set a year ago Thursday.

Speculation among traders late in the session that the market’s pullback had been severe enough to force the Federal Reserve into taking other steps to soothe the markets helped stocks rebound from their lows.

“If you can’t say that we’re oversold now I don’t know what you say. You’re at least due for a bounce if nothing else,” said Bill Stone, chief investment strategist for PNC Wealth Management.

The global plunge in stocks was under way well before Wall Street ever woke up. In Japan, the Nikkei average lost more than 4 percent. And then the losses spread across Europe — nearly 6 percent for the FTSE-100 in Britain, 7 percent for the German DAX and more than 9 percent for France’s CAC-40.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, asset rotation, bailout, bank failure, bankruptcy, banks, bear market, bonds, bridge loans, bubbles, capital, commercial paper, debt-ceiling, deficits, derivatives, economy, election, equity, federal budget, Federal Reserve, financials, govt. stats, housing, income tax, interest rates, lending standards, MBS, mortgages, president, recession, regulation, risk management, S&P 500, SEC, securitization, sentiment, subprime, unemployment, unfunded liabilities, writedowns | Tagged: comp, indu, rut, spx, wlsh |

401k, asset rotation, bailout, bank failure, bankruptcy, banks, bear market, bonds, bridge loans, bubbles, capital, commercial paper, debt-ceiling, deficits, derivatives, economy, election, equity, federal budget, Federal Reserve, financials, govt. stats, housing, income tax, interest rates, lending standards, MBS, mortgages, president, recession, regulation, risk management, S&P 500, SEC, securitization, sentiment, subprime, unemployment, unfunded liabilities, writedowns | Tagged: comp, indu, rut, spx, wlsh |  Permalink

Permalink

Posted by Jason

Posted by Jason

October 6, 2008

Mon Oct 6, 2008 5:54pm EDT

By Doris Frankel

CHICAGO, Oct 6 (Reuters) – An index regarded as Wall Street’s fear gauge surged to a record close on Monday as investors clamored for protection in anticipation of more stock market turmoil on worries over the widening credit crisis.

The Chicago Board Options Exchange Volatility Index .VIX, or VIX, surged to a record high of 58.24 before easing back to close up 15.31 percent to 52.05.

“This is absolutely amazing. The elevated VIX is reflecting that people are unsure about every financial relationship they have ever known not only in the U.S. but worldwide,” said Joe Kinahan, chief derivatives strategist at thinkorswim Group.

Persistent strains in the credit markets added to nervousness about the wider economic outlook, while a spate of bank rescues in Europe heightened worries about the stability of global financial institutions.

“Not only are the U.S. banks in financial trouble but it appears that the European and foreign banks may be in worse trouble due to the credit crisis,” Kinahan added.

The Dow Jones industrial average .DJI dropped 369.88 points to fall below 10,000 for the first time in four years. The Standard & Poor’s 500 index .SPX fell 3.85 percent to 1,056.89.

The VIX, which reflects investors’ consensus about anticipated stock market volatility over a 30-day period, tends to move inversely to the S&P 500 benchmark, and spikes upward when the market posts sharp losses.

The record level in the VIX on Monday reflects a change in the index made by the CBOE in 2003 to provide a more precise reading on stock market conditions, basing the index on the prices of the more popular S&P 500 options.

The old VIX, introduced in 1993, is based on S&P 100 options, a smaller basket of stocks. That index, the VXO .VXO ,also hit a multiyear high on Monday, closing up 14.95 percent at 59.50, after scoring a new peak of 66.42.

“With today’s high on the VXO of 66.42, it is safe to say the uncertainty now exceeds all times in recent history, with the exception of the crash of 1987 when the old VIX hit 150.19 briefly and remained above the current levels until about Oct. 29, 1987,” said Randy Frederick, director of derivatives at Charles Schwab in Austin, Texas.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, bailout, bank failure, bankruptcy, banks, bear market, bonds, buy and hold, capital, economy, equity, Federal Reserve, financials, fiscal policy, futures, gold, govt. stats, growth, relative strength, risk management, S&P 500, sentiment, subprime | Tagged: indu, spx, vix, vxo |

401k, bailout, bank failure, bankruptcy, banks, bear market, bonds, buy and hold, capital, economy, equity, Federal Reserve, financials, fiscal policy, futures, gold, govt. stats, growth, relative strength, risk management, S&P 500, sentiment, subprime | Tagged: indu, spx, vix, vxo |  Permalink

Permalink

Posted by Jason

Posted by Jason

September 10, 2008

This post is the latest in a series covering the correlation of S&P 500 price movement during the bear markets of 2001 and 2008. Previously, Is it really 2001 again? highlighted a number of similarities for both indicators and chart patterns in addition to the timing and relative resistance levels observed by both markets. This expanded on the first entry Here we are again? 2001 vs. 2008 which started the discussion by showing the two markets spending a similar amount of time above the 1400 level, meeting resistance at a similar level in the area of 1560, forming a similar double top including a final fall retest followed by an extreme decline and culminating in a spring washout setting up an early summer bounce.

The correlation remained tight as both markets failed their early summer bounce by late May in the area of the 200 day moving average and the 50% retracement level of the fall to spring decline. The correlation weakened over the summer as the current market started a much more drastic decline from the May top than occurred in 2001. This time the spring lows were broken by July instead of waiting for September as in 2001. A solid bounce from the July lows this year brought the S&P 500 back to just above the March lows where resistance was encountered around the 50 day moving average in the month of August. Suddenly the correlation has returned as the market failed in August of 2001 at the 50 day moving average also. As the calender turned to September in 2001, volume picked up as the market went into free fall. Of course the 9/11 attacks affected the market as the month progressed and forever after.

But this year, the month of September has not started off any better despite the Feds attempt to stop the bleeding in the credit markets by taking control of mortgage giants Fannie Mae (FNM) and Freddie Mac (FRE). High volume distribution has been the theme with the exception of some serious short covering following the announcement this past weekend (and late Friday for those in the loop). The bad news for the Feds and everyone else is, even as impressive as the short covering rally was Friday/Monday, it still never reclaimed the 50 day moving average nor the March lows. If the July lows at 1200 don’t hold here, a repeat of 2001 may yet be in the cards. The S&P 500 didn’t bottom until dropping under 950 in 2001 and the final bottom in 2002 saw intraday trading under 775. We’re not ready to say it will get that bad this time, but taking out the July lows would suggest scary days ahead.

But this year, the month of September has not started off any better despite the Feds attempt to stop the bleeding in the credit markets by taking control of mortgage giants Fannie Mae (FNM) and Freddie Mac (FRE). High volume distribution has been the theme with the exception of some serious short covering following the announcement this past weekend (and late Friday for those in the loop). The bad news for the Feds and everyone else is, even as impressive as the short covering rally was Friday/Monday, it still never reclaimed the 50 day moving average nor the March lows. If the July lows at 1200 don’t hold here, a repeat of 2001 may yet be in the cards. The S&P 500 didn’t bottom until dropping under 950 in 2001 and the final bottom in 2002 saw intraday trading under 775. We’re not ready to say it will get that bad this time, but taking out the July lows would suggest scary days ahead.

For those brave longs an entry at the July lows around 1200 is a good place to start. Lows for the year are regularly made in September/October.

Leave a Comment » |

Leave a Comment » |  200 day MA, 50% Retrace, bailout, bank failure, bankruptcy, banks, bear market, buy and hold, capital, charts, drawdown, economy, equity, Federal Reserve, financials, fiscal policy, foreclosure, growth, housing, MBS, mortgages, prime mortgage, recession, risk management, S&P 500, subprime, unfunded liabilities, writedowns | Tagged: fnm, fre, spx |

200 day MA, 50% Retrace, bailout, bank failure, bankruptcy, banks, bear market, buy and hold, capital, charts, drawdown, economy, equity, Federal Reserve, financials, fiscal policy, foreclosure, growth, housing, MBS, mortgages, prime mortgage, recession, risk management, S&P 500, subprime, unfunded liabilities, writedowns | Tagged: fnm, fre, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

July 18, 2008

Well, our president may not have a magic wand, but it looks like our Fed Chairman does.

This weekend Big Ben got together with his govt. cronies and they whipped up a wicked brew that is the antidote to the housing crisis and savior of all things financial. The SEC put the clamps on the shorts, the Treasury got into the mortgage underwriting business and Big Ben opened the Fed money faucet a little wider.

Hooray!??

Let’s see, that’s $30B for Bear Stearns, $8B for Indy Mac & now $5T worth of mortgages at Fannie and Freddie. I wonder if the cost of printing dollars has gone up with the increased raw material costs?

Our LD President Bush danced on the scene with an empty promise to drill the OCS for a few hundred thousand Bpd in 10 years and the world was right again.

Oil plunged, bank stocks soared. It must have brought a smile to their faces.

But is it reality? Have the finance gods truly been appeased?

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  80 week MA, asset rotation, bailout, bank failure, banks, bear market, charts, commodities, crude oil, equity, Federal Reserve, financials, fiscal policy, S&P 500, SEC, sentiment | Tagged: bsc, comp, cpc, fnm, fre, imb, indu, rut, spx, vix, wlsh |

80 week MA, asset rotation, bailout, bank failure, banks, bear market, charts, commodities, crude oil, equity, Federal Reserve, financials, fiscal policy, S&P 500, SEC, sentiment | Tagged: bsc, comp, cpc, fnm, fre, imb, indu, rut, spx, vix, wlsh |  Permalink

Permalink

Posted by Jason

Posted by Jason

Posted by Jason

Posted by Jason