October 14, 2009

DJ comeback: Stock market’s best-known barometer closes above 10,000 for 1st time in a year

By Sara Lepro and Tim Paradis, AP Business Writers

5:08 pm EDT, Wednesday October 14, 2009

NEW YORK (AP) — When the Dow Jones industrial average first passed 10,000, traders tossed commemorative caps and uncorked champagne. This time around, the feeling was more like relief.

The best-known barometer of the stock market entered five-figure territory again Wednesday, the most visible sign yet that investors believe the economy is clawing its way back from the worst downturn since the Depression.

The milestone caps a stunning 53 percent comeback for the Dow since early March, when stocks were at their lowest levels in more than a decade.

“It’s almost like an announcement that the bear market is over,” said Arthur Hogan, chief market analyst at Jefferies & Co. (JEF) in Boston. “That is an eye-opener — ‘Hey, you know what, things must be getting better because the Dow is over 10,000.'”

Cheers went up briefly when the Dow eclipsed the milestone in the early afternoon, during a daylong rally driven by encouraging earnings reports from Intel Corp. and JPMorgan Chase & Co. (JPM) The average closed at 10,015.86, up 144.80 points.

It was the first time the Dow had touched 10,000 since October 2008, that time on the way down.

“I think there were times when we were in the deep part of the trough there back in the springtime when it felt like we’d never get back to this level,” said Bernie McSherry, senior vice president of strategic initiatives at Cuttone & Co.

Ethan Harris, head of North America economics at Bank of America Merrill Lynch (BAC), described it as a “relief rally that the world is not coming to an end.”

The mood was far from the euphoria of March 1999, when the Dow surpassed 10,000 for the first time. The Internet then was driving extraordinary gains in productivity, and serious people debated whether there was such a thing as a boom without end.

“If this is a bubble,” The Wall Street Journal marveled on its front page, “it sure is hard to pop.”

It did pop, of course. And then came the lost decade.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  200 day MA, 401k, 50% Retrace, analysts, asset rotation, bailout, banks, bear market, behavioral science, bonds, bubbles, buy and hold, capital, contrarian, economy, efficient-market, equity, financial adviser, financial engineering, growth, inflation, interest rates, liquidity, psychology, real returns, recession, recovery, relative strength, risk management, sentiment, unemployment | Tagged: bac, indu, jef, jpm |

200 day MA, 401k, 50% Retrace, analysts, asset rotation, bailout, banks, bear market, behavioral science, bonds, bubbles, buy and hold, capital, contrarian, economy, efficient-market, equity, financial adviser, financial engineering, growth, inflation, interest rates, liquidity, psychology, real returns, recession, recovery, relative strength, risk management, sentiment, unemployment | Tagged: bac, indu, jef, jpm |  Permalink

Permalink

Posted by Jason

Posted by Jason

September 14, 2009

by Steve Lohr

Monday, September 14, 2009

The New York Times

In the aftermath of the great meltdown of 2008, Wall Street’s quants have been cast as the financial engineers of profit-driven innovation run amok. They, after all, invented the exotic securities that proved so troublesome.

But the real failure, according to finance experts and economists, was in the quants’ mathematical models of risk that suggested the arcane stuff was safe.

The risk models proved myopic, they say, because they were too simple-minded. They focused mainly on figures like the expected returns and the default risk of financial instruments. What they didn’t sufficiently take into account was human behavior, specifically the potential for widespread panic. When lots of investors got too scared to buy or sell, markets seized up and the models failed.

That failure suggests new frontiers for financial engineering and risk management, including trying to model the mechanics of panic and the patterns of human behavior.

“What wasn’t recognized was the importance of a different species of risk — liquidity risk,” said Stephen Figlewski, a professor of finance at the Leonard N. Stern School of Business at New York University. “When trust in counterparties is lost, and markets freeze up so there are no prices,” he said, it “really showed how different the real world was from our models.”

In the future, experts say, models need to be opened up to accommodate more variables and more dimensions of uncertainty.

The drive to measure, model and perhaps even predict waves of group behavior is an emerging field of research that can be applied in fields well beyond finance.

Much of the early work has been done tracking online behavior. The Web provides researchers with vast data sets for tracking the spread of all manner of things — news stories, ideas, videos, music, slang and popular fads — through social networks. That research has potential applications in politics, public health, online advertising and Internet commerce. And it is being done by academics and researchers at Google, Microsoft, Yahoo and Facebook.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  adaptive-markets, asset rotation, bailout, bank failure, banks, bear market, behavioral science, bubbles, buy and hold, capital, cash out, compensation, contagion, contrarian, demographics, economy, efficiency, efficient-market, entitlement, equity, financial engineering, financial literacy, financials, lending standards, leverage, liquidity, liquidity risk, loan to value, mortgages, quants, ratings, real returns, recession, recovery, regulation, risk management, securitization, sentiment, social networks, surplus, swaps, unfunded liabilities | Tagged: goog, msft, yhoo |

adaptive-markets, asset rotation, bailout, bank failure, banks, bear market, behavioral science, bubbles, buy and hold, capital, cash out, compensation, contagion, contrarian, demographics, economy, efficiency, efficient-market, entitlement, equity, financial engineering, financial literacy, financials, lending standards, leverage, liquidity, liquidity risk, loan to value, mortgages, quants, ratings, real returns, recession, recovery, regulation, risk management, securitization, sentiment, social networks, surplus, swaps, unfunded liabilities | Tagged: goog, msft, yhoo |  Permalink

Permalink

Posted by Jason

Posted by Jason

September 2, 2009

Wed Sep 2, 2009 11:14am EDT

By Steve Eder

NEW YORK (Reuters) – As shares of bailed-out banks bottomed out earlier this year, stock options were awarded to their top executives, setting them up for millions of dollars in profit as prices rebounded, according to a report released on Wednesday.

The top five executives at 10 financial institutions that took some of the biggest taxpayer bailouts have seen a combined increase in the value of their stock options of nearly $90 million, the report by the Washington-based Institute for Policy Studies said.

“Not only are these executives not hurting very much from the crisis, but they might get big windfalls because of the surge in the value of some of their shares,” said Sarah Anderson, lead author of the report, “America’s Bailout Barons,” the 16th in an annual series on executive excess.

The report — which highlights executive compensation at such firms as Goldman Sachs Group Inc. (GS), JPMorgan Chase & Co. (JPM), Morgan Stanley (MS), Bank of America Corp. (BAC) and Citigroup Inc. (C) — comes at a time when Wall Street is facing criticism for failing to scale back outsized bonuses after borrowing billions from taxpayers amid last year’s financial crisis. Goldman, JPMorgan and Morgan Stanley have paid back the money they borrowed, but Bank of America and Citigroup are still in the U.S. Treasury’s program.

It’s also the latest in a string of studies showing that despite tough talk by politicians, little has been done by regulators to rein in the bonus culture that many believe contributed to the near-collapse of the financial sector.

The report includes eight pages of legislative proposals to address executive pay, but concludes that officials have “not moved forward into law or regulation any measure that would actually deflate the executive pay bubble that has expanded so hugely over the last three decades.”

“We see these little flurries of activities in Congress, where it looked like it was going to happen,” Anderson said. “Then they would just peter out.”

The report found that while executives continued to rake in tens of millions of dollars in compensation, 160,000 employees were laid off at the top 20 financial industry firms that received bailouts.

The CEOs of those 20 companies were paid, on average, 85 times more than the regulators who direct the Securities and Exchange Commission and the Federal Deposit Insurance Corp, according to the report.

(Reporting by Steve Eder; editing by John Wallace)

Leave a Comment » |

Leave a Comment » |  401k, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, billionaires, bridge loans, bubbles, capital, cash out, civil penalties, compensation, debt-ceiling, deficits, derivatives, economy, entitlement, equity, fair value accounting, FDIC, federal budget, Federal Reserve, financials, fiscal policy, fraud, GDP, govt. stats, income tax, insider trading, lawsuits, leverage, millionaires, Obama, real returns, recession, regulation, SEC, Treasury bonds, unemployment, unfunded liabilities, writedowns | Tagged: bac, c, gs, jpm, ms |

401k, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, billionaires, bridge loans, bubbles, capital, cash out, civil penalties, compensation, debt-ceiling, deficits, derivatives, economy, entitlement, equity, fair value accounting, FDIC, federal budget, Federal Reserve, financials, fiscal policy, fraud, GDP, govt. stats, income tax, insider trading, lawsuits, leverage, millionaires, Obama, real returns, recession, regulation, SEC, Treasury bonds, unemployment, unfunded liabilities, writedowns | Tagged: bac, c, gs, jpm, ms |  Permalink

Permalink

Posted by Jason

Posted by Jason

August 27, 2009

Investors still trading Fannie, Freddie, AIG shares, even though prices are likely to hit zero

Daniel Wagner, AP Business Writer

Thursday August 27, 2009, 5:36 pm EDT

WASHINGTON (AP) — Investors are still trading common shares of Fannie Mae (FNM), Freddie Mac (FRE) and American International Group Inc. (AIG) by the billions, even though analysts say their prices are almost certain to go to zero.

All three are majority-owned by the government and are losing huge sums of money. The Securities and Exchange Commission and other regulators lack authority to end trading of stocks in such “zombie” companies that technically are alive — until the government takes them off life support.

Shares of the two mortgage giants and the insurer have been swept up in a summer rally in financial stocks. Investors have been trading their shares at abnormally high volumes, despite analysts’ warnings that they’re destined to lose their money.

“People have done well by trading them (in the short term), but when it gets to the end of the road, these stocks are going to be worth zero,” said Bose George, an analyst with the investment bank Keefe, Bruyette & Woods Inc.

Some of the activity involves day traders aiming to profit from short-term price swings, George said. But he said inexperienced investors might have the mis-impression that the companies may recover or be rescued.

“That would be kind of unfortunate,” he said. “There could be a lot of improvement in the economy, and these companies would still be worth zero.”

The government continues to support the companies with billions in taxpayer money, saying they still play a crucial role in the financial system.

Fannie and Freddie buy loans from banks and sell them to investors — a role critical to the mortgage market. They have tapped about $96 billion out of a potential $400 billion in aid from the Treasury Department.

Officials have said AIG’s failure would be disastrous for the financial markets. Treasury and the Federal Reserve have spent about $175 billion on AIG and AIG-related securities. The company also has access to $28 billion from the $700 billion financial industry bailout.

But analysts say the wind-down strategies for the companies are almost sure to wipe out any common equity, making their shares worthless.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  analysts, asset rotation, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, bubbles, buy and hold, capital, contrarian, deficits, derivatives, economy, efficiency, equity, fair value accounting, federal budget, Federal Reserve, financial literacy, financials, FINRA, fiscal policy, govt. stats, housing, lending standards, leverage, liquidity, loan to value, marked to market, MBS, mortgages, NYSE, pay-as-you-go, prime mortgage, recession, recovery, regulation, relative strength, risk management, SEC, sentiment, subprime, Treasury bonds, unfunded liabilities, writedowns | Tagged: aig, fnm, fre, ge, gm |

analysts, asset rotation, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, bubbles, buy and hold, capital, contrarian, deficits, derivatives, economy, efficiency, equity, fair value accounting, federal budget, Federal Reserve, financial literacy, financials, FINRA, fiscal policy, govt. stats, housing, lending standards, leverage, liquidity, loan to value, marked to market, MBS, mortgages, NYSE, pay-as-you-go, prime mortgage, recession, recovery, regulation, relative strength, risk management, SEC, sentiment, subprime, Treasury bonds, unfunded liabilities, writedowns | Tagged: aig, fnm, fre, ge, gm |  Permalink

Permalink

Posted by Jason

Posted by Jason

August 22, 2009

Sat Aug 22, 2009 12:18pm EDT

CHICAGO (Reuters) – Exchange-traded funds or ETFs have become a top target in U.S. regulators’ efforts to rein in excessive speculation in oil and other commodity markets, The Wall Street Journal reported on Saturday.

Commodity ETFs, which came into existence in 2003, offer one of the few avenues for small investors to gain direct exposure to commodity markets. The funds pool money from investors to make one-way bets, usually on rising prices.

Some say this causes excessive buying that artificially inflates prices for oil, natural gas and gold.

Commodity ETFs have ballooned to hold $59.3 billion in assets as of July, according to the National Stock Exchange, which tracks ETF data.

The Commodity Futures Trading Commission has said it seeks to protect end users of commodities, and that cutting out individual investors is not the goal.

“The Commission has never said, ‘You aren’t tall enough to ride,'” CFTC Commissioner Bart Chilton was quoted as saying in the WSJ article. “I don’t want to limit liquidity, but above all else, I want to ensure that prices for consumers are fair and that there is no manipulation — intentional or otherwise.”

Limiting the size of ETFs will result in higher costs for investors, the WSJ reported, because legal and operational costs have to be spread out over a fewer number of shares. Investors range from individuals to banks and hedge funds with multimillion-dollar positions.

The CFTC is currently considering a host of measures to curb excessive speculation, including position limits in U.S. futures markets. Many U.S. lawmakers called for greater regulation of some commodity markets after a price surge last year sent crude oil to a record high of $147 a barrel in July 2008.

(Reporting by Matthew Lewis; Editing by Toni Reinhold)

Leave a Comment » |

Leave a Comment » |  agriculture, asset rotation, banks, behavioral science, bubbles, capital, CFTC, coal, commodities, contrarian, copper, crude oil, derivatives, efficiency, equity, Exchange Traded Funds/Notes, futures, gasoline prices, gold, govt. stats, growth, inflation, leverage, liquidity, natural gas, optimization, peak oil, real returns, regulation, risk management, securitization, sentiment, silver, swaps | Tagged: dbo, dgl, gaz, gld, iau, ung, uso |

agriculture, asset rotation, banks, behavioral science, bubbles, capital, CFTC, coal, commodities, contrarian, copper, crude oil, derivatives, efficiency, equity, Exchange Traded Funds/Notes, futures, gasoline prices, gold, govt. stats, growth, inflation, leverage, liquidity, natural gas, optimization, peak oil, real returns, regulation, risk management, securitization, sentiment, silver, swaps | Tagged: dbo, dgl, gaz, gld, iau, ung, uso |  Permalink

Permalink

Posted by Jason

Posted by Jason

August 12, 2009

Release Date: August 12, 2009

For immediate release

Information received since the Federal Open Market Committee met in June suggests that economic activity is leveling out. Conditions in financial markets have improved further in recent weeks. Household spending has continued to show signs of stabilizing but remains constrained by ongoing job losses, sluggish income growth, lower housing wealth, and tight credit. Businesses are still cutting back on fixed investment and staffing but are making progress in bringing inventory stocks into better alignment with sales. Although economic activity is likely to remain weak for a time, the Committee continues to anticipate that policy actions to stabilize financial markets and institutions, fiscal and monetary stimulus, and market forces will contribute to a gradual resumption of sustainable economic growth in a context of price stability.

The prices of energy and other commodities have risen of late. However, substantial resource slack is likely to dampen cost pressures, and the Committee expects that inflation will remain subdued for some time.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. As previously announced, to provide support to mortgage lending and housing markets and to improve overall conditions in private credit markets, the Federal Reserve will purchase a total of up to $1.25 trillion of agency mortgage-backed securities and up to $200 billion of agency debt by the end of the year. In addition, the Federal Reserve is in the process of buying $300 billion of Treasury securities. To promote a smooth transition in markets as these purchases of Treasury securities are completed, the Committee has decided to gradually slow the pace of these transactions and anticipates that the full amount will be purchased by the end of October. The Committee will continue to evaluate the timing and overall amounts of its purchases of securities in light of the evolving economic outlook and conditions in financial markets. The Federal Reserve is monitoring the size and composition of its balance sheet and will make adjustments to its credit and liquidity programs as warranted.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

2009 Monetary Policy Releases

Leave a Comment » |

Leave a Comment » |  bailout, bear market, behavioral science, bonds, bridge loans, commodities, debt-ceiling, deficits, economy, Federal Reserve, fiscal policy, govt. stats, growth, housing, inflation, interest rates, lending standards, liquidity, MBS, mortgages, prime mortgage, recession, recovery, regulation, sentiment, Treasury bonds |

bailout, bear market, behavioral science, bonds, bridge loans, commodities, debt-ceiling, deficits, economy, Federal Reserve, fiscal policy, govt. stats, growth, housing, inflation, interest rates, lending standards, liquidity, MBS, mortgages, prime mortgage, recession, recovery, regulation, sentiment, Treasury bonds |  Permalink

Permalink

Posted by Jason

Posted by Jason

August 3, 2009

By Sara Lepro and Tim Paradis, AP Business Writers

Monday August 3, 2009, 6:02 pm EDT

NEW YORK (AP) — The Standard & Poor’s 500 index (SPX) is four digits again now that the stock market’s rally has blown into August.

The widely followed stock market measure broke above 1,000 on Monday for the first time in nine months as reports on manufacturing, construction and banking sent investors more signals that the economy is gathering strength. The S&P is used as a benchmark by professional investors, and it’s also the foundation for mutual funds in many individual 401(k) accounts.

Wall Street’s big indexes all rose more than 1 percent, including the Dow Jones industrial average (INDU), which climbed 115 points.

The market extended its summer rally on the type of news that might have seemed unthinkable when stocks cratered to 12-year lows in early March. A trade group predicted U.S. manufacturing activity will grow next month, the government said construction spending rose in June and Ford Motor Co. (F) said its sales rose last month for the first time in nearly two years.

“The market is beginning to smell economic recovery,” said Howard Ward, portfolio manager of GAMCO Growth Fund. “It may be too early to declare victory, but we are well on our way.”

The day’s reports were the latest indications that the recession that began in December 2007 could be retreating. Better corporate earnings reports and economic data propelled the Dow Jones industrial average 725 points in July to its best month in nearly seven years and restarted spring rally that had stalled in June.

On Monday, a report from the Institute for Supply Management, a trade group of purchasing executives, signaled U.S. manufacturing activity should increase next month for the first time since January 2008 as industrial companies restock shelves. Also, the Commerce Department said construction spending rose rather than fell in June as analysts had expected. The reports and rising commodity prices lifted energy and material stocks.

Ford said sales of light vehicles rose 1.6 percent in July. Other major automakers said they saw signs of stability in sales. Investors predicted that the government’s popular cash for clunkers program would boost overall auto sales to their highest level of the year.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, analysts, asset rotation, bailout, banks, bear market, behavioral science, bonds, buy and hold, capital, China, commodities, copper, crude oil, economy, equity, financials, govt. stats, growth, interest rates, liquidity, mutual fund, real returns, recession, recovery, relative strength, risk management, S&P 500, sentiment, small caps, Treasury bonds, unemployment | Tagged: bcs, cat, comp, f, hsbc, indu, intc, rut, spx, usd |

401k, analysts, asset rotation, bailout, banks, bear market, behavioral science, bonds, buy and hold, capital, China, commodities, copper, crude oil, economy, equity, financials, govt. stats, growth, interest rates, liquidity, mutual fund, real returns, recession, recovery, relative strength, risk management, S&P 500, sentiment, small caps, Treasury bonds, unemployment | Tagged: bcs, cat, comp, f, hsbc, indu, intc, rut, spx, usd |  Permalink

Permalink

Posted by Jason

Posted by Jason

July 28, 2009

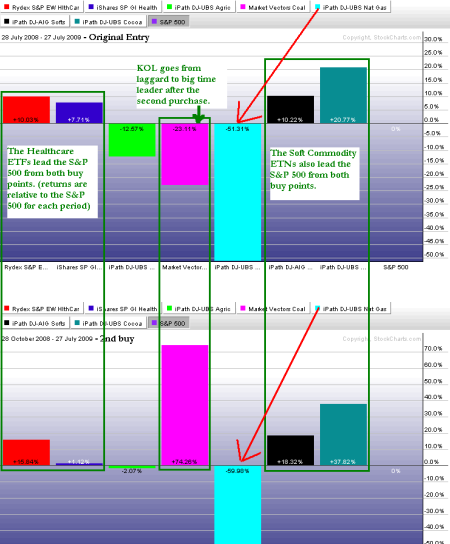

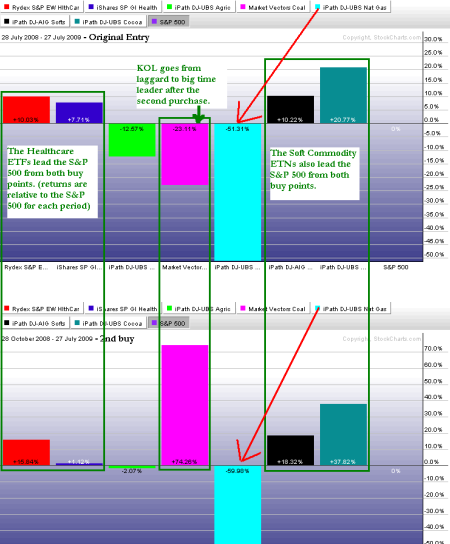

Here is an update on our ETF/ETN picks that are one year old today.

Not your normal 12 months by any stretch.

Staying disciplined and taking what the market gives leaves us well ahead of the market in even the worst of times.

ETF/ETN picks after 1 year

Leave a Comment » |

Leave a Comment » |  agriculture, asset rotation, bear market, behavioral science, buy and hold, charts, commodities, contrarian, drawdown, equity, Exchange Traded Funds/Notes, healthcare, real returns, recession, relative strength, risk management, S&P 500, writedowns |

agriculture, asset rotation, bear market, behavioral science, buy and hold, charts, commodities, contrarian, drawdown, equity, Exchange Traded Funds/Notes, healthcare, real returns, recession, relative strength, risk management, S&P 500, writedowns |  Permalink

Permalink

Posted by Jason

Posted by Jason

July 24, 2009

Fri Jul 24, 2009 12:31pm EDT

By Rachel Chang

NEW YORK, July 24 (Reuters) – The collapse of Lehman Brothers (LEH) last September marked the start of a downward spiral for big investment banks. For a smaller fraternity of Internet brokerages, it has set off a dramatic spurt of growth.

Since the start of the financial crisis, $32.2 billion has flowed into the two largest online outfits, TD Ameritrade Holding Corp (AMTD) and Charles Schwab Corp (SCHW), company records show.

By contrast, investors have pulled more than $100 billion from traditional full-service brokerages like Citigroup Inc’s Smith Barney (C) and Bank of America-Merrill Lynch (BAC).

Of course, Americans still keep more of their wealth with established brokerages. According to research firm Gartner, 43 percent of individual investors were with full-service brokers last year, compared with 24 percent with online outfits.

And while figures for 2009 are not yet available, the flow of investors in the past 10 months has clearly been in the direction of the online brokerages, according to analysts both at Gartner and research consultancy Celent.

Joining the exodus is Ben Mallah, who says he lost $3 million in a Smith Barney account in St. Petersburg, Florida, as the markets crashed last year.

“I will never again trust anyone who is commission-driven to manage my portfolio,” said Mallah. “If they’re not making money off you, they have no use for you.”

This trend, a product of both the financial crisis and the emergence of a new generation of tech-savvy, cost-conscious young investors, is positioning online outfits as increasingly important in the wealth management field.

The numbers reflect a loss of faith in professional money managers as small investors dress their wounds from the hammering they took over the last year, the Internet brokerages say.

“There has been an awakening,” said Don Montanaro, chief executive of TradeKing, which reported a post-Lehman spike in new accounts of 121 percent. Investors now realize they alone are responsible for their money, he said.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, analysts, asset rotation, bank failure, banks, bear market, behavioral science, buy and hold, capital, cash out, civil penalties, class action, compensation, demographics, efficiency, entitlement, equity, financial adviser, financial literacy, fraud, growth, insider trading, lawsuits, leverage, optimization, organic, real returns, regulation, relative strength, risk management, S&P 500, sentiment | Tagged: amtd, bac, c, etfc, leh, ms, schw |

401k, analysts, asset rotation, bank failure, banks, bear market, behavioral science, buy and hold, capital, cash out, civil penalties, class action, compensation, demographics, efficiency, entitlement, equity, financial adviser, financial literacy, fraud, growth, insider trading, lawsuits, leverage, optimization, organic, real returns, regulation, relative strength, risk management, S&P 500, sentiment | Tagged: amtd, bac, c, etfc, leh, ms, schw |  Permalink

Permalink

Posted by Jason

Posted by Jason

June 23, 2009

by Stephanie Powers

Investopedia

Tuesday, June 23, 2009

Millionaires have more in common with each other than just their bank accounts — for some millionaires, striking it rich took courage, salesmanship, vision and passion. Find out which traits are most common to the seven-figure bank account set, and what you can do to hone some of these skills in your own life.

1. Independent Thinking

Millionaires think differently. Not just about money, about everything. The time and energy everybody else spends attempting to conform, millionaires spend creating their own path. Since thoughts impact actions, people who want to be wealthy should think in a way that will get them to that goal. Independent thinking doesn’t mean doing the opposite of what the rest of the world is doing; it means having the courage to follow what is important to you. So, the lesson here is to forge your own way, and let your success drive you to financial spoils – rather than doing it the other way around and trying to chase the money.

Just look at David Geffen. A self-made millionaire with $4.5 billion to his name in 2009, this American record executive and film producer was college dropout, but made millions founding record agencies and signed some of the most prominent musicians of the 1970s and ’80s. Although he didn’t take what many assume to be the usual path to success, his tireless work ethic and sense of personal conviction about artists’ potential allowed him to rack up a sizable fortune.

2. Vision

Millionaires are creative visionaries with a positive attitude. In other words, wealthy people not only have big dreams, they also believe they will come true. As such, wealth seekers should set lofty goals and not be afraid of uncharted territories.

Bill Gates, the world’s richest person in 2009, did just that. The American chairman of Microsoft (MSFT) is one of the founding entrepreneurs who brought personal computers to the masses. Gates jumped into the personal computers business in 1975 and held on tight, creating Microsoft Windows in 1985. When consumers began to bring computers into their homes, Gates was ready to profit from this new age.

3. Skills

Writer Dennis Kimbro interviewed successful people to determine the traits they had in common for his book, “Think and Grow Rich” (1992). He found that they concentrated on their area of excellence. Millionaires also tend to partner with others to supplement their weaker skills. If you don’t know what you are good at, poll friends and family. Use training and mentors to refine your strong skills.

4. Passion

Billionaire investing guru Warren Buffett says “Money is a by-product of something I like to do very much.” Enjoying your work allows you to have the discipline to work hard at it every day. People who interact with money for a living, bankers for example, often love creating new deals and persuading others to complete a transaction. But finding your dream job may take time. The average millionaire doesn’t find it until age 45, and tends to be 54 (on average) before becoming a millionaire. Kimbro found that millionaires tried an average of 17 ventures before they were successful. So, if you want to be rich, stop doing things you don’t enjoy and do what you love. If you don’t know what you love, try a few things and keep trying until you hit on the right thing.

5. Investment

Millionaires are willing to sacrifice time and money to achieve their goals. They are willing to take a risk now for the opportunity of achieving something greater in the future. Investing may include securities or starting a business – either way, it is a step toward achieving great financial rewards. Start investing now.

6. Salesmanship

Millionaires are constantly presenting their ideas and persuading others to buy into them. Good salesmen are oblivious to critics and naysayers. In other words, they don’t take “no” for an answer. Millionaires also have good social skills. In fact, when writer T. Harv Eker analyzed the results of a survey of 753 millionaires for his book, “Secrets of the Millionaire Mind” (2005), he found social skills were more important than IQ. Just look at Donald Trump. His fortune has fluctuated over the years, but his ability to sell himself – whether as a TV personality or as the force behind a line of neckties – has always brought him back among the ranks of celebrity millionaires.

The ability to communicate with people is essential to selling your idea. Contrary to the traditional view of salesmen, millionaires cite honesty as an important factor in their success. If you want to be a millionaire, be an honest salesman and polish your social skills.

***

Becoming a millionaire is not a goal that can be achieved overnight for most people. In fact, many of the world’s richest people built their wealth over many years (sometimes even generations) by making smart but often bold decisions, putting their skills to the best use possible and doggedly pursuing their vision. If you can learn anything about millionaires, it’s that for many of them, their riches are not necessarily what most sets them apart from the rest of the world – it’s what they did to earn those millions that really stands out.

Leave a Comment » |

Leave a Comment » |  behavioral science, compensation, contrarian, economy, efficiency, entitlement, financial literacy, growth, leverage, liquidity, millionaires, organic, real returns, relative strength, risk management, sentiment | Tagged: msft |

behavioral science, compensation, contrarian, economy, efficiency, entitlement, financial literacy, growth, leverage, liquidity, millionaires, organic, real returns, relative strength, risk management, sentiment | Tagged: msft |  Permalink

Permalink

Posted by Jason

Posted by Jason

June 15, 2009

by Paul Sullivan

The New York Times

Monday, June 15, 2009

Tony Guernsey has been in the wealth management business for four decades. But clients have started asking him a question that at first caught him off guard: How do I know I own what you tell me I own?

This is the existential crisis rippling through wealth management right now, in the wake of the unraveling of Bernard L. Madoff’s long-running Ponzi scheme. Mr. Guernsey, the head of national wealth management at Wilmington Trust, says he understands why investors are asking the question, but it still unnerves him. “They got their statements from Madoff, and now they get their statement from XYZ Corporation. And they say, ‘How do I know they exist?’ ”

When he is asked this, Mr. Guernsey says he walks clients through the checks and balances that a 106-year-old firm like Wilmington has. Still, this is the ultimate reverberation from the Madoff scandal: trust, the foundation between wealth manager and client, has been called into question, if not destroyed.

“It used to be that if you owned I.B.M., you could pull the certificate out of your sock drawer,” said Dan Rauchle, president of Wells Fargo Alternative Asset Management. “Once we moved away from that, we got into this world of trusting others to know what we owned.”

The process of restoring that trust may take time. But in the meantime, investors may be putting their faith in misguided ways of ensuring trust. Mr. Madoff, after all, was not charged after an investigation by the Securities and Exchange Commission a year before his firm collapsed. Here are some considerations:

CUT THROUGH THE CLUTTER Financial disclosure rules compel money managers to send out statements. The problem is that the statements and trade confirmations arrive so frequently, they fail to help investors understand what they own.

To mitigate this, many wealth management firms have developed their own systems to track and present client assets. HSBC Private Bank has had WealthTrack for nearly five years, while Barclays Wealth is introducing Wealth Management Reporting. But there are many more, including a popular one from Advent Software.

These systems consolidate the values of securities, partnerships and, in some cases, assets like homes and jewelry. HSBC’s program takes into account the different ways firms value assets by finding a common trading date. It also breaks out the impact of currency fluctuation..

These systems have limits, though. “Our reporting is only as good as the data we receive,” said Mary Duke, head of global wealth solutions for the Americas at HSBC Private Bank. “A hedge fund’s value depends on when the hedge fund reports — if it reports a month-end value, but we get it a month late.”

In other words, no consolidation program is foolproof.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, analysts, asset rotation, bank failure, banks, bear market, behavioral science, billionaires, bonds, bubbles, buy and hold, capital, compensation, demographics, equity, Exchange Traded Funds/Notes, financial adviser, financial literacy, fraud, gold, growth, liquidity, marked to market, MBS, municipals, mutual fund, real returns, recession, regulation, relative strength, risk management, SEC, sentiment | Tagged: bcs, hsbc, pnc, wfc |

401k, analysts, asset rotation, bank failure, banks, bear market, behavioral science, billionaires, bonds, bubbles, buy and hold, capital, compensation, demographics, equity, Exchange Traded Funds/Notes, financial adviser, financial literacy, fraud, gold, growth, liquidity, marked to market, MBS, municipals, mutual fund, real returns, recession, regulation, relative strength, risk management, SEC, sentiment | Tagged: bcs, hsbc, pnc, wfc |  Permalink

Permalink

Posted by Jason

Posted by Jason

June 4, 2009

Thu Jun 4, 2009 7:41pm EDT

By Gina Keating and Rachelle Younglai

LOS ANGELES/WASHINGTON (Reuters) – Angelo Mozilo, who built the largest U.S. mortgage lender, was charged with securities fraud and insider trading on Thursday, making him the most prominent defendant so far in investigations into the U.S. subprime mortgage crisis and housing bust.

Mozilo, 70, co-founder of Countrywide Financial Corp (CFC), was accused by the U.S. Securities and Exchange Commission with making more than $139 million in profits in 2006 and 2007 from exercising 5.1 million stock options and selling the underlying shares.

The sales were under four prearranged stock trading plans Mozilo prepared during the time period, the SEC said.

The accusations were made in a civil lawsuit filed by the SEC in Los Angeles on Thursday.

The SEC said that in one instance, the day before he set up a stock trading plan on September 25, 2006, Mozilo sent an email to two Countrywide executives that said: “We are flying blind on how these loans will perform in a stressed environment of higher unemployment, reduced values and slowing home sales.”

Those executives, then Countrywide President David Sambol, 49, and Chief Financial Officer Eric Sieracki, 52, were charged by the SEC with knowingly writing “riskier and riskier” subprime loans that they had a limited ability to sell on the secondary mortgage market.

The SEC said that all three executives failed to tell investors how dependent Countrywide had become on its ability to sell subprime mortgages on the secondary market. All three were accused of hiding from investors the risks they took to win market share.

At one stage, Countrywide was writing almost 1 in 6 of American mortgages. The lawsuit said that by September 2006, Countrywide estimated that it had a 15.7 percent share of the market, up from 11.4 percent at the end of 2003.

“While Countrywide boasted to investors that its market share was increasing, company executives did not disclose that its market share increase came at the expense of prudent underwriting guidelines,” the lawsuit said

Bank of America Corp (BAC) bought Countrywide last July 1 for $2.5 billion, less than a tenth of what it had been worth in early 2007.

“TWO COMPANIES”, EARLY WARNING SIGNS

“This is a tale of two companies,” the SEC’s director of enforcement, Robert Khuzami, told reporters. “One that investors from the outside saw. It was allegedly characterized by prudent business practices and tightly controlled risk.”

“But the real Countrywide, which could only be seen from the inside, was one buckling under the weight of deteriorating mortgages, lax underwriting, and an increasingly suspect business model,” Khuzami said.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  analysts, ARM, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, bubbles, builders, capital, civil penalties, compensation, contrarian, economy, entitlement, equity, fair value accounting, financials, foreclosure, fraud, GDP, Great Depression, growth, housing, income tax, inflation, insider trading, interest only, interest rates, lawsuits, lending standards, leverage, liquidity, loan to value, mortgages, prime mortgage, ratings, real returns, recession, regulation, risk management, SEC, securitization, sentiment, short-selling, subprime, unemployment, unfunded liabilities, writedowns | Tagged: bac, cfc |

analysts, ARM, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, bubbles, builders, capital, civil penalties, compensation, contrarian, economy, entitlement, equity, fair value accounting, financials, foreclosure, fraud, GDP, Great Depression, growth, housing, income tax, inflation, insider trading, interest only, interest rates, lawsuits, lending standards, leverage, liquidity, loan to value, mortgages, prime mortgage, ratings, real returns, recession, regulation, risk management, SEC, securitization, sentiment, short-selling, subprime, unemployment, unfunded liabilities, writedowns | Tagged: bac, cfc |  Permalink

Permalink

Posted by Jason

Posted by Jason

April 30, 2009

by Laura Rowley

Thursday, April 30, 2009, 12:00AM

If you want to be happy, pay attention.

That’s the conclusion of the new book ‘Rapt: Attention and the Focused Life’ by behavioral science writer Winifred Gallagher. Interviewing neuroscientists, psychologists, philosophers, and others, Gallagher argues that your happiness depends in large part on where and how you choose to place your focus.

Paying attention sounds like a no-brainer, but it’s similar to the platitude “Live within your means” — it makes a gigantic difference in your well-being, yet many people can’t figure out how to do it. Gallagher breaks down the science of attention, explaining what happens in the brain when we focus on something; why certain things grab our attention and can sabotage our mood, creativity, and productivity; and how to take control of the tool of attention to create a more fulfilling life. At its heart, the book optimistically affirms that no one is a victim of his circumstances — no matter how difficult those circumstances might be.

Gallagher knows that territory intimately. The book was inspired by her battle with cancer a few years ago. “When I got the diagnosis, I interviewed doctors, talked to friends who went through it, chose the best surgeon and radiologist in the best hospital for me,” she recalls. “And once I did that, I made the executive decision to hand my body over to them and direct my attention to moving forward with life. That’s not to say I was happy, or thought, ‘Gee, cancer, what a blessing.’ I hated it. But I didn’t let it monopolize my focus.”

Shifting Your Attention

Instead, she shifted her attention to what was engaging and meaningful. “I would get up in the morning and look in the mirror; I was bald and I could have thought, ‘I don’t feel good, I’ll lie here in bed and watch Oprah.’ But I got dressed and booted up the computer,” she says, adding that she also concentrated on her five children and day-to-day tasks. “The thing that impressed me was it really worked. We do have much more control over our attention than we think.”

Perhaps first and foremost, “you have to choose your target,” says Gallagher. “If you don’t choose a target, your brain will choose one for you — the brain is out scanning around and saying, ‘Let’s stare at that screen, let’s listen to that infomercial.’ When you focus on something, your brain photographs that sight or sound or thought or feeling –and that becomes part of your mental album of the world. So it’s important to make those choices count.”

And when it’s not deliberately focused, the brain tends to home in on bad news. “We evolved to pay attention to painful, negative feelings for the excellent reason that if something is scaring you or making you angry, you are motivated to do something about it,” says Gallagher.

The problem is, research has shown that “negative feelings shrink your visual and conceptual reality, which limits your options,” Gallagher explains. “The attentional issue is particularly important now, when so many people are under terrific financial stress. You can’t focus on it 24/7. Focusing on the positive literally broadens your visual field; you can take in the big picture, both visually and conceptually, consider more options. You’re in a better decision-making space.”

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  behavioral science, contrarian, flow, growth, healthcare, optimization, organic, relative strength, sentiment |

behavioral science, contrarian, flow, growth, healthcare, optimization, organic, relative strength, sentiment |  Permalink

Permalink

Posted by Jason

Posted by Jason

March 2, 2009

According to some of our proprietary research, March is an outlier month.

Without going into too much detail, we have found that the month of March historically behaves in an unexpected, atypical manner. This has compromised otherwise solid systems to the point that we simply do not trade some systems only during the month of March. March has produced significant turns in long term trends historically, including the top in March of 2000 and the ensuing final bottom in March of 2003. A significant bottom was made in late March of 1994, which launched the market into the massive bull that ended in 2000. Many other minor trend changes also occur frequently in the month of March.

Various explanations have been offered for this phenomenon, including the Ides of March. One cannot discount the cultural and religious significance of the March equinox either. While we are certain the cause is a number of factors, one that seems to stick out to us is the timing for the end of the first quarter. Many things are happening around this time of year from a fundamental standpoint including closing the books on the first quarter, which not only sets the tone for the new year, but in many cases finalizes budgets also. Fourth quarter and end of year earnings are being reported around this time to the public as well. More importantly, it is the first triple-witch expiration of the year. Recently, this has become quadruple-witching with the addition of Single Stock Futures (SSFs), but historically it has been a triple-witch event. This event alone is known to cause weird things to happen, so much so it is called “freaky Friday” as it occurs on the third Friday of March, June, September & December.

Whatever the reason, if you feel something strange or think that people are just being crazy, it could be true. Whether the cause is internal, external, fundamental or fabricated is not nearly as important as how you prepare yourself. Be aware and alert. Take advantage of the situation or just sit it out.

Please share any March experiences or planning that you have in the comments section below. I know I am missing many things and will come back to this note as I come across or remember them.

1 Comment |

1 Comment |  analysts, asset rotation, bear market, behavioral science, capital, contrarian, economy, equity, fair value accounting, futures, growth, real returns, recession, relative strength, risk management, sentiment, triple witch |

analysts, asset rotation, bear market, behavioral science, capital, contrarian, economy, equity, fair value accounting, futures, growth, real returns, recession, relative strength, risk management, sentiment, triple witch |  Permalink

Permalink

Posted by Jason

Posted by Jason

Posted by Jason

Posted by Jason