May 10, 2010

By DONNA KARDOS YESALAVICH And KRISTINA PETERSON

Reuters

Stocks posted their biggest one-day gain in more than a year, boosted by the bailout package to stem Europe’s credit crisis.

The Dow Jones Industrial Average jumped 404.71 points, or 3.9%, to 10785.14, helped by gains in all 30 of its components. The average had its biggest one-day gain in both point and percentage terms since March 23, 2009.

The Standard & Poor’s 500-stock index rose 4.4% to 1159.73, led by its financial and consumer-discretionary sectors, up more than 5% each. All the broad measure’s other indexes posted gains as well.

The jump in U.S. stocks followed rallies in the Asian and European markets after the European Union agreed to a €750 billion ($954.83 billion) bailout, including €440 billion of loans from euro-zone governments., €60 billion from a European Union emergency fund and €250 billion from the International Monetary Fund.

In further coordinated efforts to assuage spooked markets, the European Central Bank will go into the secondary market to buy euro-zone national bonds—a step last week that its president, Jean-Claude Trichet, said the central bank didn’t even contemplate. Meanwhile, the Federal Reserve, working with other central banks, re-activated swap lines so foreign institutions can get access to loans.

“This bailout plan really avoided the worst-case scenario—it avoided contagion and the domino effect,” said Cort Gwon, director of trading strategies of FBN Securities. The package also shifts investors’ attention back to the U.S., where most economic yardsticks have been improving lately, he noted.

The Nasdaq Composite jumped 109.03 points, its first triple-digit point gain since October 2008. It closed at 2374.67, up 4.8%.

Trading volume was higher than the 2010 daily average, though below the frenzied pace of the previous two days, which included an unprecedented “flash crash” and traders’ scramble to square their books after certain trades were canceled. On Monday, composite New York Stock Exchange volume hit 7.1 billion shares, below last week’s peak near 11 billion.

U.S.-listed shares of European banks surged in reaction to the European Union’s bailout plan.

Leave a Comment » |

Leave a Comment » |  asset rotation, bailout, bankruptcy, bear market, bonds, bridge loans, capital, contagion, corporate bonds, deficits, ECB, economy, Federal Reserve, financial engineering, fiscal policy, flash crash, growth, IMF, inflation, liquidity, liquidity risk, NYSE, Obama, risk management, S&P 500, sentiment, socialized risks, swaps, unfunded liabilities | Tagged: comp, indu, spx |

asset rotation, bailout, bankruptcy, bear market, bonds, bridge loans, capital, contagion, corporate bonds, deficits, ECB, economy, Federal Reserve, financial engineering, fiscal policy, flash crash, growth, IMF, inflation, liquidity, liquidity risk, NYSE, Obama, risk management, S&P 500, sentiment, socialized risks, swaps, unfunded liabilities | Tagged: comp, indu, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

May 6, 2010

Meltdown probe hears from bailout architects Paulson, Geithner on ‘shadow banking’

Daniel Wagner, AP Business Writer, On Thursday May 6, 2010, 12:57 am EDT

WASHINGTON (AP) — A special panel investigating the financial crisis is preparing to hear from two key architects of the government’s response: Former Treasury Secretary Henry Paulson and Treasury Secretary Timothy Geithner.

Geithner and Paulson will provide their perspectives on the so-called “shadow banking system” — a largely unregulated world of capital and credit markets outside of traditional banks. They will describe their roles in selling Bear Stearns (BSC) to JPMorgan Chase & Co. (JPM) after pressure from “shadow banking” companies made Bear the first major casualty of the crisis.

The pair will testify Thursday morning before the Financial Crisis Inquiry Commission, a bipartisan panel established by Congress to probe the roots of the financial crisis. It is the first time the panel has heard from either of the men who called the shots in late 2008 as the global financial system nearly collapsed.

The panel is looking at nonbank financial companies such as PIMCO and GE Capital that provide capital for loans to consumers and small businesses. When rumors spread in 2008 that Bear Stearns was teetering, these companies started what former Bear Stearns executives described Wednesday as a “run on the bank,” drawing so much of its capital that it could not survive.

Then-Treasury Secretary Paulson and Geithner, as president of the Federal Reserve Bank of New York, engineered Bear’s rescue. The New York Fed put up a $29 billion federal backstop to limit JPMorgan’s future losses on Bear Stearns’ bad investments.

Bear Stearns was the first Wall Street bank to blow up. Its demise foreshadowed the cascading financial meltdown in the fall of that year.

The panel is investigating the roots of the crisis that plunged the country into the most severe recession since the 1930s and brought losses of jobs and homes for millions of Americans.

In earlier testimony before the House Committee on Oversight and Government Reform, Paulson defended his response to the economic crisis as an imperfect but necessary rescue that spared the U.S. financial market from total collapse.

“Many more Americans would be without their homes, their jobs, their businesses, their savings and their way of life,” he said in testimony prepared for that hearing.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  bailout, bank failure, bankruptcy, bear market, bubbles, capital, cash out, civil penalties, contagion, credit rating agencies, derivatives, equity, federal budget, Federal Reserve, financial engineering, fiscal policy, leverage, liquidity, liquidity risk, marked to market, recession, regulation, risk management, SEC, sentiment, shadow banking, short-selling, socialized risks, subprime, unfunded liabilities, writedowns | Tagged: bsc, ge, jpm, stt |

bailout, bank failure, bankruptcy, bear market, bubbles, capital, cash out, civil penalties, contagion, credit rating agencies, derivatives, equity, federal budget, Federal Reserve, financial engineering, fiscal policy, leverage, liquidity, liquidity risk, marked to market, recession, regulation, risk management, SEC, sentiment, shadow banking, short-selling, socialized risks, subprime, unfunded liabilities, writedowns | Tagged: bsc, ge, jpm, stt |  Permalink

Permalink

Posted by Jason

Posted by Jason

November 18, 2009

Wed Nov 18, 2009 5:13am EST

By Jan Harvey

LONDON (Reuters) – Gold hit a fresh record high near $1,150 an ounce on Wednesday, boosting precious metals across the board, as a dip in the dollar index added to momentum buying as prices broke through key technical resistance levels.

In non-U.S. dollar terms, gold also climbed, hitting multi-month highs when priced in the euro, sterling and the Australian dollar.

Spot gold hit a high of $1,147.45 and was at $1,146.05 an ounce at 0948 GMT, against $1,141.50 late in New York on Tuesday.

U.S. gold futures for December delivery on the COMEX division of the New York Mercantile Exchange also hit a record $1,148.10 and were later up $7.10 at $1,146.40 an ounce.

“Yesterday the market took a breather and tested below $1,130 very quickly, (but) a few physical related bargain hunters were lined up to grab the dip,” said Afshin Nabavi, head of trading at MKS Finance in Geneva.

The market is being underpinned by fresh interest in gold from the official sector, he said, after a recent major bullion acquisition from India and smaller buys by the central banks of Mauritius and Sri Lanka.

The acquisitions underlined gold’s appeal as a portfolio diversifier, especially in an environment where further dollar weakness was expected, analysts said.

The dollar eased back on Wednesday from its biggest rise in three weeks in the previous session, as traders awaited U.S. inflation data due at 1330 GMT.

The dollar index, which measures the U.S. currency’s performance against a basket of six others, was down 0.37 percent, while the euro/dollar exchange rate firmed.

Other commodities also climbed, with oil rising back toward $80 a barrel and copper to 13-1/3 month highs near $7,000 a tonne. Both are being lifted by the weak dollar.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  asset rotation, bailout, bank failure, bankruptcy, bear market, bubbles, capital, commodities, copper, CPI, crude oil, debt-ceiling, deficits, economy, efficient-market, Exchange Traded Funds/Notes, federal budget, Federal Reserve, financial engineering, fraud, futures, gold, govt. stats, inflation, interest rates, leverage, liquidity, psychology, real returns, recession, relative strength, risk management, sentiment, silver, unfunded liabilities | Tagged: gld, gold, slv, usd |

asset rotation, bailout, bank failure, bankruptcy, bear market, bubbles, capital, commodities, copper, CPI, crude oil, debt-ceiling, deficits, economy, efficient-market, Exchange Traded Funds/Notes, federal budget, Federal Reserve, financial engineering, fraud, futures, gold, govt. stats, inflation, interest rates, leverage, liquidity, psychology, real returns, recession, relative strength, risk management, sentiment, silver, unfunded liabilities | Tagged: gld, gold, slv, usd |  Permalink

Permalink

Posted by Jason

Posted by Jason

November 16, 2009

By Amy Hoak

DOW JONES

House shopping usually slows down in the winter, as people put their home searches on hold to trim the tree, buy presents to put under it and avoid the chilly weather.

This winter, however, might be different, thanks to the extended–and expanded–first-time home-buyer tax credit.

“We’re going to see far more interest in the fourth quarter than we generally do because of the tax credit,” said Heather Fernandez, vice president of Trulia.com, a real estate search engine. Traffic surged on the site on Nov. 5, the day Congress approved the credit extension, she said.

The new law extends the tax credit for first-time home buyers and opens it up to some existing homeowners as well: The credit is now 10% of the home price, up to $8,000 for first-time buyers and up to $6,500 for repeat buyers.

All buyers must have a binding contract on a house in place on or before April 30. The sale must close on or before June 30.

To be considered a first-time home buyer, an individual must not have owned a home in the past three years. And to be eligible, existing homeowners need to have lived in the same principal residence for five consecutive years during the eight-year period that ends when the new home is purchased. The credit is only for principal residences.

Income limits have risen as well. According to the IRS, the home-buyer tax credit now phases out for individuals with modified adjusted gross incomes between $125,000 and $145,000, and between $225,000 and $245,000 for people filing joint returns.

Will Credit Spur More Buyers?

The inclusion of move-up buyers might inspire homeowners to take action and list their house if they’ve been putting it off, said Carolyn Warren, a Seattle, Wash.-based mortgage broker and banker and author of the book “Homebuyers Beware.”

“If somebody loves their home, it’s not going to entice them to sell. If they’ve had it in the back of their minds and really would like to move up, it might push them into doing it sooner than later,” Warren said.

The credit isn’t expected to have as large of an effect on move-up buyers as it has on first-time buyers, according to the Campbell/Inside Mortgage Finance Monthly Survey of Real Estate Market Conditions. The maximum tax credit is about 4% of the average purchase price for first-time buyers, but about 2% of the average purchase price for move-up buyers.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  analysts, bailout, bankruptcy, banks, bonds, builders, capital, economy, efficient-market, federal budget, financial engineering, first-time home buyer tax credit, fiscal policy, foreclosure, GDP, govt. stats, growth, home prices, housing, income tax, inflation, interest rates, lending standards, liquidity, MBS, mortgages, new home sales, Obama, president, prime mortgage, real returns, recession, recovery, sentiment, socialized risks, unfunded liabilities |

analysts, bailout, bankruptcy, banks, bonds, builders, capital, economy, efficient-market, federal budget, financial engineering, first-time home buyer tax credit, fiscal policy, foreclosure, GDP, govt. stats, growth, home prices, housing, income tax, inflation, interest rates, lending standards, liquidity, MBS, mortgages, new home sales, Obama, president, prime mortgage, real returns, recession, recovery, sentiment, socialized risks, unfunded liabilities |  Permalink

Permalink

Posted by Jason

Posted by Jason

October 21, 2009

Wed Oct 21, 2009 1:30am EDT

By David Lawder

WASHINGTON (Reuters) – The U.S. government’s $700 billion financial bailout program has increased moral hazard in the markets by infusing capital into banks that caused the financial crisis, a watchdog for the program said on Wednesday.

The special inspector general for the U.S. Treasury’s Troubled Asset Relief Program (TARP) said the plan put in place a year ago was clearly influencing market behavior, and he repeated that taxpayers may never recoup all their money.

The bailout fund may have helped avert a financial system collapse but it could reinforce perceptions the government will step in to keep firms from failing, the quarterly report from inspector general Neil Barofsky said.

He said there continued to be conflicts of interest around credit rating agencies that failed to warn of risks leading up to the financial crisis. The report added that the recent rebound in big bank stocks risked removing urgency of dealing with the financial system’s problems.

“Absent meaningful regulatory reform, TARP runs the risk of merely reanimating markets that had collapsed under the weight of reckless behavior,” the report said. “The firms that were ‘too big to fail’ last October are in many cases bigger still, many as a result of government-supported and -sponsored mergers and acquisitions.”

ANGER, CYNICISM, DISTRUST

The report cites an erosion of government credibility associated with a lack of transparency, particularly in the early handling of the program’s initial investments in large financial institutions.

“Notwithstanding the TARP’s role in bringing the financial system back from the brink of collapse, it has been widely reported that the American people view TARP with anger, cynicism and distrust. These views are fueled by the lack of transparency in the program,” the report said.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, analysts, bailout, bank failure, bankruptcy, banks, bear market, billionaires, bridge loans, bubbles, capital, civil penalties, class action, commercial paper, compensation, contagion, corporate bonds, credit rating agencies, derivatives, economy, efficient-market, entitlement, equity, fair value accounting, Federal Reserve, financial engineering, fraud, income tax, inflation, insider trading, interest rates, lawsuits, lending standards, leverage, liquidity, liquidity risk, marked to market, MBS, mortgages, preferred, ratings, real returns, recession, recovery, regulation, risk management, SEC, securitization, sentiment, socialized risks, subprime, swaps, TALF, TARP, transparency, unfunded liabilities, writedowns |

401k, analysts, bailout, bank failure, bankruptcy, banks, bear market, billionaires, bridge loans, bubbles, capital, civil penalties, class action, commercial paper, compensation, contagion, corporate bonds, credit rating agencies, derivatives, economy, efficient-market, entitlement, equity, fair value accounting, Federal Reserve, financial engineering, fraud, income tax, inflation, insider trading, interest rates, lawsuits, lending standards, leverage, liquidity, liquidity risk, marked to market, MBS, mortgages, preferred, ratings, real returns, recession, recovery, regulation, risk management, SEC, securitization, sentiment, socialized risks, subprime, swaps, TALF, TARP, transparency, unfunded liabilities, writedowns |  Permalink

Permalink

Posted by Jason

Posted by Jason

October 14, 2009

DJ comeback: Stock market’s best-known barometer closes above 10,000 for 1st time in a year

By Sara Lepro and Tim Paradis, AP Business Writers

5:08 pm EDT, Wednesday October 14, 2009

NEW YORK (AP) — When the Dow Jones industrial average first passed 10,000, traders tossed commemorative caps and uncorked champagne. This time around, the feeling was more like relief.

The best-known barometer of the stock market entered five-figure territory again Wednesday, the most visible sign yet that investors believe the economy is clawing its way back from the worst downturn since the Depression.

The milestone caps a stunning 53 percent comeback for the Dow since early March, when stocks were at their lowest levels in more than a decade.

“It’s almost like an announcement that the bear market is over,” said Arthur Hogan, chief market analyst at Jefferies & Co. (JEF) in Boston. “That is an eye-opener — ‘Hey, you know what, things must be getting better because the Dow is over 10,000.'”

Cheers went up briefly when the Dow eclipsed the milestone in the early afternoon, during a daylong rally driven by encouraging earnings reports from Intel Corp. and JPMorgan Chase & Co. (JPM) The average closed at 10,015.86, up 144.80 points.

It was the first time the Dow had touched 10,000 since October 2008, that time on the way down.

“I think there were times when we were in the deep part of the trough there back in the springtime when it felt like we’d never get back to this level,” said Bernie McSherry, senior vice president of strategic initiatives at Cuttone & Co.

Ethan Harris, head of North America economics at Bank of America Merrill Lynch (BAC), described it as a “relief rally that the world is not coming to an end.”

The mood was far from the euphoria of March 1999, when the Dow surpassed 10,000 for the first time. The Internet then was driving extraordinary gains in productivity, and serious people debated whether there was such a thing as a boom without end.

“If this is a bubble,” The Wall Street Journal marveled on its front page, “it sure is hard to pop.”

It did pop, of course. And then came the lost decade.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  200 day MA, 401k, 50% Retrace, analysts, asset rotation, bailout, banks, bear market, behavioral science, bonds, bubbles, buy and hold, capital, contrarian, economy, efficient-market, equity, financial adviser, financial engineering, growth, inflation, interest rates, liquidity, psychology, real returns, recession, recovery, relative strength, risk management, sentiment, unemployment | Tagged: bac, indu, jef, jpm |

200 day MA, 401k, 50% Retrace, analysts, asset rotation, bailout, banks, bear market, behavioral science, bonds, bubbles, buy and hold, capital, contrarian, economy, efficient-market, equity, financial adviser, financial engineering, growth, inflation, interest rates, liquidity, psychology, real returns, recession, recovery, relative strength, risk management, sentiment, unemployment | Tagged: bac, indu, jef, jpm |  Permalink

Permalink

Posted by Jason

Posted by Jason

October 6, 2009

Energy breakthroughs could be the next big thing, but how many jobs can they generate?

By Jordan Robertson, AP Technology Writer

9:33 pm EDT, Tuesday October 6, 2009

SAN FRANCISCO (AP) — Our economy sure could use the Next Big Thing. Something on the scale of railroads, automobiles or the Internet — the kind of breakthrough that emerges every so often and builds industries, generates jobs and mints fortunes.

Silicon Valley investors are pointing to something called cleantech — alternative energy, more efficient power distribution and new ways to store electricity, all with minimal impact to the environment — as a candidate for the next boom.

And while no two booms are exactly alike, some hallmarks are already showing up.

Despite last fall’s financial meltdown, public and private investments are pouring in, fueling startups and reinvigorating established companies. The political and social climates are favorable. If it takes off, cleantech could seep into every part of the economy and our lives.

Some of the biggest booms first blossomed during recessions. The telephone and phonograph were developed during the depression of the 1870s. The integrated circuit, a milestone in electronics, was invented in the recessionary year of 1958. Personal computers went mainstream, spawning a huge industry, in the slumping early 1980s.

A year into the Great Recession, innovation isn’t slowing. This time, it’s better batteries, more efficient solar cells, smarter appliances and electric cars, not to mention all the infrastructure needed to support the new ways energy will be generated and the new ways we’ll be using it.

Yet for all the benefits that might be spawned by cleantech breakthroughs, no one knows how many jobs might be created — or how many old jobs might be cannibalized. It also remains to be seen whether Americans will clamor for any of its products.

Still, big bets are being placed. The Obama administration is pledging to invest $150 billion over the next decade on energy technology and says that could create 5 million jobs. This recession has wiped out 7.2 million.

And cleantech is on track to be the dominant force in venture capital investments over the next few years, supplanting biotechnology and software. Venture capitalists have poured $8.7 billion into energy-related startups in the U.S. since 2006.

That pales in comparison with the dot-com boom, when venture cash sometimes topped $10 billion in a single quarter. But the momentum surrounding clean energy is reminiscent of the Internet’s early days. Among the similarities: Although big projects are still dominated by large companies, the scale of the challenges requires innovation by smaller firms that hope to be tomorrow’s giants.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  adaptive-markets, alt. energy, asset rotation, bear market, bubbles, capital, cash out, coal, commodities, conservation, economy, global warming, green stocks, growth, liquidity, pollution, real returns, recession, recovery, regulation, relative strength, solar, tech stocks, unemployment | Tagged: aes, aone, btu, dow, ge, goog, hpq, ibm, su, t |

adaptive-markets, alt. energy, asset rotation, bear market, bubbles, capital, cash out, coal, commodities, conservation, economy, global warming, green stocks, growth, liquidity, pollution, real returns, recession, recovery, regulation, relative strength, solar, tech stocks, unemployment | Tagged: aes, aone, btu, dow, ge, goog, hpq, ibm, su, t |  Permalink

Permalink

Posted by Jason

Posted by Jason

September 14, 2009

by Steve Lohr

Monday, September 14, 2009

The New York Times

In the aftermath of the great meltdown of 2008, Wall Street’s quants have been cast as the financial engineers of profit-driven innovation run amok. They, after all, invented the exotic securities that proved so troublesome.

But the real failure, according to finance experts and economists, was in the quants’ mathematical models of risk that suggested the arcane stuff was safe.

The risk models proved myopic, they say, because they were too simple-minded. They focused mainly on figures like the expected returns and the default risk of financial instruments. What they didn’t sufficiently take into account was human behavior, specifically the potential for widespread panic. When lots of investors got too scared to buy or sell, markets seized up and the models failed.

That failure suggests new frontiers for financial engineering and risk management, including trying to model the mechanics of panic and the patterns of human behavior.

“What wasn’t recognized was the importance of a different species of risk — liquidity risk,” said Stephen Figlewski, a professor of finance at the Leonard N. Stern School of Business at New York University. “When trust in counterparties is lost, and markets freeze up so there are no prices,” he said, it “really showed how different the real world was from our models.”

In the future, experts say, models need to be opened up to accommodate more variables and more dimensions of uncertainty.

The drive to measure, model and perhaps even predict waves of group behavior is an emerging field of research that can be applied in fields well beyond finance.

Much of the early work has been done tracking online behavior. The Web provides researchers with vast data sets for tracking the spread of all manner of things — news stories, ideas, videos, music, slang and popular fads — through social networks. That research has potential applications in politics, public health, online advertising and Internet commerce. And it is being done by academics and researchers at Google, Microsoft, Yahoo and Facebook.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  adaptive-markets, asset rotation, bailout, bank failure, banks, bear market, behavioral science, bubbles, buy and hold, capital, cash out, compensation, contagion, contrarian, demographics, economy, efficiency, efficient-market, entitlement, equity, financial engineering, financial literacy, financials, lending standards, leverage, liquidity, liquidity risk, loan to value, mortgages, quants, ratings, real returns, recession, recovery, regulation, risk management, securitization, sentiment, social networks, surplus, swaps, unfunded liabilities | Tagged: goog, msft, yhoo |

adaptive-markets, asset rotation, bailout, bank failure, banks, bear market, behavioral science, bubbles, buy and hold, capital, cash out, compensation, contagion, contrarian, demographics, economy, efficiency, efficient-market, entitlement, equity, financial engineering, financial literacy, financials, lending standards, leverage, liquidity, liquidity risk, loan to value, mortgages, quants, ratings, real returns, recession, recovery, regulation, risk management, securitization, sentiment, social networks, surplus, swaps, unfunded liabilities | Tagged: goog, msft, yhoo |  Permalink

Permalink

Posted by Jason

Posted by Jason

September 2, 2009

Wed Sep 2, 2009 11:14am EDT

By Steve Eder

NEW YORK (Reuters) – As shares of bailed-out banks bottomed out earlier this year, stock options were awarded to their top executives, setting them up for millions of dollars in profit as prices rebounded, according to a report released on Wednesday.

The top five executives at 10 financial institutions that took some of the biggest taxpayer bailouts have seen a combined increase in the value of their stock options of nearly $90 million, the report by the Washington-based Institute for Policy Studies said.

“Not only are these executives not hurting very much from the crisis, but they might get big windfalls because of the surge in the value of some of their shares,” said Sarah Anderson, lead author of the report, “America’s Bailout Barons,” the 16th in an annual series on executive excess.

The report — which highlights executive compensation at such firms as Goldman Sachs Group Inc. (GS), JPMorgan Chase & Co. (JPM), Morgan Stanley (MS), Bank of America Corp. (BAC) and Citigroup Inc. (C) — comes at a time when Wall Street is facing criticism for failing to scale back outsized bonuses after borrowing billions from taxpayers amid last year’s financial crisis. Goldman, JPMorgan and Morgan Stanley have paid back the money they borrowed, but Bank of America and Citigroup are still in the U.S. Treasury’s program.

It’s also the latest in a string of studies showing that despite tough talk by politicians, little has been done by regulators to rein in the bonus culture that many believe contributed to the near-collapse of the financial sector.

The report includes eight pages of legislative proposals to address executive pay, but concludes that officials have “not moved forward into law or regulation any measure that would actually deflate the executive pay bubble that has expanded so hugely over the last three decades.”

“We see these little flurries of activities in Congress, where it looked like it was going to happen,” Anderson said. “Then they would just peter out.”

The report found that while executives continued to rake in tens of millions of dollars in compensation, 160,000 employees were laid off at the top 20 financial industry firms that received bailouts.

The CEOs of those 20 companies were paid, on average, 85 times more than the regulators who direct the Securities and Exchange Commission and the Federal Deposit Insurance Corp, according to the report.

(Reporting by Steve Eder; editing by John Wallace)

Leave a Comment » |

Leave a Comment » |  401k, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, billionaires, bridge loans, bubbles, capital, cash out, civil penalties, compensation, debt-ceiling, deficits, derivatives, economy, entitlement, equity, fair value accounting, FDIC, federal budget, Federal Reserve, financials, fiscal policy, fraud, GDP, govt. stats, income tax, insider trading, lawsuits, leverage, millionaires, Obama, real returns, recession, regulation, SEC, Treasury bonds, unemployment, unfunded liabilities, writedowns | Tagged: bac, c, gs, jpm, ms |

401k, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, billionaires, bridge loans, bubbles, capital, cash out, civil penalties, compensation, debt-ceiling, deficits, derivatives, economy, entitlement, equity, fair value accounting, FDIC, federal budget, Federal Reserve, financials, fiscal policy, fraud, GDP, govt. stats, income tax, insider trading, lawsuits, leverage, millionaires, Obama, real returns, recession, regulation, SEC, Treasury bonds, unemployment, unfunded liabilities, writedowns | Tagged: bac, c, gs, jpm, ms |  Permalink

Permalink

Posted by Jason

Posted by Jason

August 27, 2009

Investors still trading Fannie, Freddie, AIG shares, even though prices are likely to hit zero

Daniel Wagner, AP Business Writer

Thursday August 27, 2009, 5:36 pm EDT

WASHINGTON (AP) — Investors are still trading common shares of Fannie Mae (FNM), Freddie Mac (FRE) and American International Group Inc. (AIG) by the billions, even though analysts say their prices are almost certain to go to zero.

All three are majority-owned by the government and are losing huge sums of money. The Securities and Exchange Commission and other regulators lack authority to end trading of stocks in such “zombie” companies that technically are alive — until the government takes them off life support.

Shares of the two mortgage giants and the insurer have been swept up in a summer rally in financial stocks. Investors have been trading their shares at abnormally high volumes, despite analysts’ warnings that they’re destined to lose their money.

“People have done well by trading them (in the short term), but when it gets to the end of the road, these stocks are going to be worth zero,” said Bose George, an analyst with the investment bank Keefe, Bruyette & Woods Inc.

Some of the activity involves day traders aiming to profit from short-term price swings, George said. But he said inexperienced investors might have the mis-impression that the companies may recover or be rescued.

“That would be kind of unfortunate,” he said. “There could be a lot of improvement in the economy, and these companies would still be worth zero.”

The government continues to support the companies with billions in taxpayer money, saying they still play a crucial role in the financial system.

Fannie and Freddie buy loans from banks and sell them to investors — a role critical to the mortgage market. They have tapped about $96 billion out of a potential $400 billion in aid from the Treasury Department.

Officials have said AIG’s failure would be disastrous for the financial markets. Treasury and the Federal Reserve have spent about $175 billion on AIG and AIG-related securities. The company also has access to $28 billion from the $700 billion financial industry bailout.

But analysts say the wind-down strategies for the companies are almost sure to wipe out any common equity, making their shares worthless.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  analysts, asset rotation, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, bubbles, buy and hold, capital, contrarian, deficits, derivatives, economy, efficiency, equity, fair value accounting, federal budget, Federal Reserve, financial literacy, financials, FINRA, fiscal policy, govt. stats, housing, lending standards, leverage, liquidity, loan to value, marked to market, MBS, mortgages, NYSE, pay-as-you-go, prime mortgage, recession, recovery, regulation, relative strength, risk management, SEC, sentiment, subprime, Treasury bonds, unfunded liabilities, writedowns | Tagged: aig, fnm, fre, ge, gm |

analysts, asset rotation, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, bubbles, buy and hold, capital, contrarian, deficits, derivatives, economy, efficiency, equity, fair value accounting, federal budget, Federal Reserve, financial literacy, financials, FINRA, fiscal policy, govt. stats, housing, lending standards, leverage, liquidity, loan to value, marked to market, MBS, mortgages, NYSE, pay-as-you-go, prime mortgage, recession, recovery, regulation, relative strength, risk management, SEC, sentiment, subprime, Treasury bonds, unfunded liabilities, writedowns | Tagged: aig, fnm, fre, ge, gm |  Permalink

Permalink

Posted by Jason

Posted by Jason

August 22, 2009

Sat Aug 22, 2009 12:18pm EDT

CHICAGO (Reuters) – Exchange-traded funds or ETFs have become a top target in U.S. regulators’ efforts to rein in excessive speculation in oil and other commodity markets, The Wall Street Journal reported on Saturday.

Commodity ETFs, which came into existence in 2003, offer one of the few avenues for small investors to gain direct exposure to commodity markets. The funds pool money from investors to make one-way bets, usually on rising prices.

Some say this causes excessive buying that artificially inflates prices for oil, natural gas and gold.

Commodity ETFs have ballooned to hold $59.3 billion in assets as of July, according to the National Stock Exchange, which tracks ETF data.

The Commodity Futures Trading Commission has said it seeks to protect end users of commodities, and that cutting out individual investors is not the goal.

“The Commission has never said, ‘You aren’t tall enough to ride,'” CFTC Commissioner Bart Chilton was quoted as saying in the WSJ article. “I don’t want to limit liquidity, but above all else, I want to ensure that prices for consumers are fair and that there is no manipulation — intentional or otherwise.”

Limiting the size of ETFs will result in higher costs for investors, the WSJ reported, because legal and operational costs have to be spread out over a fewer number of shares. Investors range from individuals to banks and hedge funds with multimillion-dollar positions.

The CFTC is currently considering a host of measures to curb excessive speculation, including position limits in U.S. futures markets. Many U.S. lawmakers called for greater regulation of some commodity markets after a price surge last year sent crude oil to a record high of $147 a barrel in July 2008.

(Reporting by Matthew Lewis; Editing by Toni Reinhold)

Leave a Comment » |

Leave a Comment » |  agriculture, asset rotation, banks, behavioral science, bubbles, capital, CFTC, coal, commodities, contrarian, copper, crude oil, derivatives, efficiency, equity, Exchange Traded Funds/Notes, futures, gasoline prices, gold, govt. stats, growth, inflation, leverage, liquidity, natural gas, optimization, peak oil, real returns, regulation, risk management, securitization, sentiment, silver, swaps | Tagged: dbo, dgl, gaz, gld, iau, ung, uso |

agriculture, asset rotation, banks, behavioral science, bubbles, capital, CFTC, coal, commodities, contrarian, copper, crude oil, derivatives, efficiency, equity, Exchange Traded Funds/Notes, futures, gasoline prices, gold, govt. stats, growth, inflation, leverage, liquidity, natural gas, optimization, peak oil, real returns, regulation, risk management, securitization, sentiment, silver, swaps | Tagged: dbo, dgl, gaz, gld, iau, ung, uso |  Permalink

Permalink

Posted by Jason

Posted by Jason

August 3, 2009

By Sara Lepro and Tim Paradis, AP Business Writers

Monday August 3, 2009, 6:02 pm EDT

NEW YORK (AP) — The Standard & Poor’s 500 index (SPX) is four digits again now that the stock market’s rally has blown into August.

The widely followed stock market measure broke above 1,000 on Monday for the first time in nine months as reports on manufacturing, construction and banking sent investors more signals that the economy is gathering strength. The S&P is used as a benchmark by professional investors, and it’s also the foundation for mutual funds in many individual 401(k) accounts.

Wall Street’s big indexes all rose more than 1 percent, including the Dow Jones industrial average (INDU), which climbed 115 points.

The market extended its summer rally on the type of news that might have seemed unthinkable when stocks cratered to 12-year lows in early March. A trade group predicted U.S. manufacturing activity will grow next month, the government said construction spending rose in June and Ford Motor Co. (F) said its sales rose last month for the first time in nearly two years.

“The market is beginning to smell economic recovery,” said Howard Ward, portfolio manager of GAMCO Growth Fund. “It may be too early to declare victory, but we are well on our way.”

The day’s reports were the latest indications that the recession that began in December 2007 could be retreating. Better corporate earnings reports and economic data propelled the Dow Jones industrial average 725 points in July to its best month in nearly seven years and restarted spring rally that had stalled in June.

On Monday, a report from the Institute for Supply Management, a trade group of purchasing executives, signaled U.S. manufacturing activity should increase next month for the first time since January 2008 as industrial companies restock shelves. Also, the Commerce Department said construction spending rose rather than fell in June as analysts had expected. The reports and rising commodity prices lifted energy and material stocks.

Ford said sales of light vehicles rose 1.6 percent in July. Other major automakers said they saw signs of stability in sales. Investors predicted that the government’s popular cash for clunkers program would boost overall auto sales to their highest level of the year.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, analysts, asset rotation, bailout, banks, bear market, behavioral science, bonds, buy and hold, capital, China, commodities, copper, crude oil, economy, equity, financials, govt. stats, growth, interest rates, liquidity, mutual fund, real returns, recession, recovery, relative strength, risk management, S&P 500, sentiment, small caps, Treasury bonds, unemployment | Tagged: bcs, cat, comp, f, hsbc, indu, intc, rut, spx, usd |

401k, analysts, asset rotation, bailout, banks, bear market, behavioral science, bonds, buy and hold, capital, China, commodities, copper, crude oil, economy, equity, financials, govt. stats, growth, interest rates, liquidity, mutual fund, real returns, recession, recovery, relative strength, risk management, S&P 500, sentiment, small caps, Treasury bonds, unemployment | Tagged: bcs, cat, comp, f, hsbc, indu, intc, rut, spx, usd |  Permalink

Permalink

Posted by Jason

Posted by Jason

July 27, 2009

By Marcy Gordon, AP Business Writer

Monday July 27, 2009, 8:03 pm EDT

WASHINGTON (AP) — Federal regulators on Monday made permanent an emergency rule put in at the height of last fall’s market turmoil that aims to reduce abusive short-selling.

The Securities and Exchange Commission announced that it took the action on the rule targeting so-called “naked” short-selling, which was due to expire Friday.

Short-sellers bet against a stock. They generally borrow a company’s shares, sell them, and then buy them when the stock falls and return them to the lender — pocketing the difference in price.

“Naked” short-selling occurs when sellers don’t even borrow the shares before selling them, and then look to cover positions sometime after the sale.

The SEC rule includes a requirement that brokers must promptly buy or borrow securities to deliver on a short sale.

Brokers acting for short sellers must find a party believed to be able to deliver the shares within three days after the short-sale trade. If the shares aren’t delivered within that time, there is deemed to be a “failure to deliver.” Brokers can be subject to penalties if the failure to deliver isn’t resolved by the start of trading on the following day.

At the same time, the SEC has been considering several new approaches to reining in rushes of regular short-selling that also can cause dramatic plunges in stock prices.

Investors and lawmakers have been clamoring for the SEC to put new brakes on trading moves they say worsened the market’s downturn starting last fall. SEC Chairman Mary Schapiro has said she is making the issue a priority.

Some securities industry officials, however, have maintained that the SEC’s emergency order on “naked” short-selling brought unintended negative consequences, such as wilder price swings and turbulence in the market.

The five SEC commissioners voted in April to put forward for public comment five alternative short-selling plans. One option is restoring a Depression-era rule that prohibits short sellers from making their trades until a stock ticks at least one penny above its previous trading price. The goal of the so-called uptick rule is to prevent selling sprees that feed upon themselves — actions that battered the stocks of banks and other companies over the last year.

Another approach would ban short-selling for the rest of the trading session in a stock that declines by 10 percent or more.

Schapiro said last week the SEC could decide on a final course of action in “the next several weeks or several months.”

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, bailout, bank failure, bankruptcy, banks, bear market, bubbles, capital, civil penalties, debt-ceiling, economy, efficiency, equity, financial literacy, financials, fiscal policy, govt. stats, Great Depression, insider trading, lawsuits, liquidity, recession, regulation, risk management, SEC, sentiment, short-selling, writedowns |

401k, bailout, bank failure, bankruptcy, banks, bear market, bubbles, capital, civil penalties, debt-ceiling, economy, efficiency, equity, financial literacy, financials, fiscal policy, govt. stats, Great Depression, insider trading, lawsuits, liquidity, recession, regulation, risk management, SEC, sentiment, short-selling, writedowns |  Permalink

Permalink

Posted by Jason

Posted by Jason

July 24, 2009

Fri Jul 24, 2009 12:31pm EDT

By Rachel Chang

NEW YORK, July 24 (Reuters) – The collapse of Lehman Brothers (LEH) last September marked the start of a downward spiral for big investment banks. For a smaller fraternity of Internet brokerages, it has set off a dramatic spurt of growth.

Since the start of the financial crisis, $32.2 billion has flowed into the two largest online outfits, TD Ameritrade Holding Corp (AMTD) and Charles Schwab Corp (SCHW), company records show.

By contrast, investors have pulled more than $100 billion from traditional full-service brokerages like Citigroup Inc’s Smith Barney (C) and Bank of America-Merrill Lynch (BAC).

Of course, Americans still keep more of their wealth with established brokerages. According to research firm Gartner, 43 percent of individual investors were with full-service brokers last year, compared with 24 percent with online outfits.

And while figures for 2009 are not yet available, the flow of investors in the past 10 months has clearly been in the direction of the online brokerages, according to analysts both at Gartner and research consultancy Celent.

Joining the exodus is Ben Mallah, who says he lost $3 million in a Smith Barney account in St. Petersburg, Florida, as the markets crashed last year.

“I will never again trust anyone who is commission-driven to manage my portfolio,” said Mallah. “If they’re not making money off you, they have no use for you.”

This trend, a product of both the financial crisis and the emergence of a new generation of tech-savvy, cost-conscious young investors, is positioning online outfits as increasingly important in the wealth management field.

The numbers reflect a loss of faith in professional money managers as small investors dress their wounds from the hammering they took over the last year, the Internet brokerages say.

“There has been an awakening,” said Don Montanaro, chief executive of TradeKing, which reported a post-Lehman spike in new accounts of 121 percent. Investors now realize they alone are responsible for their money, he said.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, analysts, asset rotation, bank failure, banks, bear market, behavioral science, buy and hold, capital, cash out, civil penalties, class action, compensation, demographics, efficiency, entitlement, equity, financial adviser, financial literacy, fraud, growth, insider trading, lawsuits, leverage, optimization, organic, real returns, regulation, relative strength, risk management, S&P 500, sentiment | Tagged: amtd, bac, c, etfc, leh, ms, schw |

401k, analysts, asset rotation, bank failure, banks, bear market, behavioral science, buy and hold, capital, cash out, civil penalties, class action, compensation, demographics, efficiency, entitlement, equity, financial adviser, financial literacy, fraud, growth, insider trading, lawsuits, leverage, optimization, organic, real returns, regulation, relative strength, risk management, S&P 500, sentiment | Tagged: amtd, bac, c, etfc, leh, ms, schw |  Permalink

Permalink

Posted by Jason

Posted by Jason

July 21, 2009

Denied federal bailout, CIT taps $3B private rescue; may be strategy for other troubled banks

By Daniel Wagner and Stevenson Jacobs, AP Business Writers

Tuesday July 21, 2009, 12:44 am EDT

WASHINGTON (AP) — With bondholders coming to the rescue of troubled commercial lender CIT Group Inc. (CIT), and not the government, a new reality is setting in for investors.

With federal bailouts drying up and the economy still in distress, many more financial firms could face bankruptcy. When they do, it will be major private lenders that will have to decide whether to rescue the companies or allow them to fail.

It signals a return to the traditional path for financially troubled firms after nearly a year of government aid.

“It wasn’t clear that Treasury wanted this to be a turning point, but that’s the way it’s worked out,” said Simon Johnson, a former chief economist with the International Monetary Fund, now a professor at the Massachusetts Institute of Technology’s Sloan School of Management.

Johnson said the markets took so kindly to CIT’s quest for private-sector cash that the government “would feel pretty comfortable about” threatening bankruptcy for firms with less than $100 billion in assets.

Bondholders’ $3 billion rescue of CIT marks the first time since the banking crisis erupted that private investors have stepped in to save a big financial firm without federal help or oversight.

The lifeline for CIT, whose clients include Dunkin’ Donuts franchises and clothing maker Eddie Bauer, aims to sustain the company long enough for it to rework its heavy debt load, which includes $7.4 billion due in the first quarter of next year. It does not guarantee CIT will avoid bankruptcy.

CIT said late Monday that the rescue includes a $3 billion secured term loan with a 2.5-year maturity, which will ensure that its small and midsized business customers continue to have access to credit. Term loan proceeds of $2 billion are committed and available immediately, with an additional $1 billion expected to be committed and available within 10 days.

The short-term financing comes at a high price — an interest rate of about 10.5 percent, said a person close to the negotiations who was not authorized to discuss the matter publicly.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  bailout, bank failure, bankruptcy, banks, bear market, bonds, bridge loans, capital, corporate bonds, debt-ceiling, deficits, economy, equity, federal budget, Federal Reserve, financials, fiscal policy, govt. stats, income tax, lending standards, liquidity, recession, regional banks, regulation, relative strength, risk management, sentiment, swaps | Tagged: bac, bsc, c, cit, mer, wm |

bailout, bank failure, bankruptcy, banks, bear market, bonds, bridge loans, capital, corporate bonds, debt-ceiling, deficits, economy, equity, federal budget, Federal Reserve, financials, fiscal policy, govt. stats, income tax, lending standards, liquidity, recession, regional banks, regulation, relative strength, risk management, sentiment, swaps | Tagged: bac, bsc, c, cit, mer, wm |  Permalink

Permalink

Posted by Jason

Posted by Jason

June 15, 2009

by Paul Sullivan

The New York Times

Monday, June 15, 2009

Tony Guernsey has been in the wealth management business for four decades. But clients have started asking him a question that at first caught him off guard: How do I know I own what you tell me I own?

This is the existential crisis rippling through wealth management right now, in the wake of the unraveling of Bernard L. Madoff’s long-running Ponzi scheme. Mr. Guernsey, the head of national wealth management at Wilmington Trust, says he understands why investors are asking the question, but it still unnerves him. “They got their statements from Madoff, and now they get their statement from XYZ Corporation. And they say, ‘How do I know they exist?’ ”

When he is asked this, Mr. Guernsey says he walks clients through the checks and balances that a 106-year-old firm like Wilmington has. Still, this is the ultimate reverberation from the Madoff scandal: trust, the foundation between wealth manager and client, has been called into question, if not destroyed.

“It used to be that if you owned I.B.M., you could pull the certificate out of your sock drawer,” said Dan Rauchle, president of Wells Fargo Alternative Asset Management. “Once we moved away from that, we got into this world of trusting others to know what we owned.”

The process of restoring that trust may take time. But in the meantime, investors may be putting their faith in misguided ways of ensuring trust. Mr. Madoff, after all, was not charged after an investigation by the Securities and Exchange Commission a year before his firm collapsed. Here are some considerations:

CUT THROUGH THE CLUTTER Financial disclosure rules compel money managers to send out statements. The problem is that the statements and trade confirmations arrive so frequently, they fail to help investors understand what they own.

To mitigate this, many wealth management firms have developed their own systems to track and present client assets. HSBC Private Bank has had WealthTrack for nearly five years, while Barclays Wealth is introducing Wealth Management Reporting. But there are many more, including a popular one from Advent Software.

These systems consolidate the values of securities, partnerships and, in some cases, assets like homes and jewelry. HSBC’s program takes into account the different ways firms value assets by finding a common trading date. It also breaks out the impact of currency fluctuation..

These systems have limits, though. “Our reporting is only as good as the data we receive,” said Mary Duke, head of global wealth solutions for the Americas at HSBC Private Bank. “A hedge fund’s value depends on when the hedge fund reports — if it reports a month-end value, but we get it a month late.”

In other words, no consolidation program is foolproof.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  401k, analysts, asset rotation, bank failure, banks, bear market, behavioral science, billionaires, bonds, bubbles, buy and hold, capital, compensation, demographics, equity, Exchange Traded Funds/Notes, financial adviser, financial literacy, fraud, gold, growth, liquidity, marked to market, MBS, municipals, mutual fund, real returns, recession, regulation, relative strength, risk management, SEC, sentiment | Tagged: bcs, hsbc, pnc, wfc |

401k, analysts, asset rotation, bank failure, banks, bear market, behavioral science, billionaires, bonds, bubbles, buy and hold, capital, compensation, demographics, equity, Exchange Traded Funds/Notes, financial adviser, financial literacy, fraud, gold, growth, liquidity, marked to market, MBS, municipals, mutual fund, real returns, recession, regulation, relative strength, risk management, SEC, sentiment | Tagged: bcs, hsbc, pnc, wfc |  Permalink

Permalink

Posted by Jason

Posted by Jason

June 9, 2009

Tue Jun 9, 2009 6:09pm EDT

By Glenn Somerville

WASHINGTON (Reuters) – JPMorgan (JPM), Goldman Sachs (GS) and eight other top U.S. banks won clearance on Tuesday to repay $68 billion in taxpayer money given to them during the credit crisis, a step that may help them escape government curbs on executive pay.

Many banks had chafed at restrictions on pay that accompanied the capital injections. The U.S. Treasury Department’s announcement that some will be permitted to repay funds from the Troubled Asset Relief Program, or TARP, begins to separate the stronger banks from weaker ones as the financial sector heals.

Treasury didn’t name the banks, but all quickly stepped forward to say they were cleared to return money the government had pumped into them to try to ensure the banking system was well capitalized

Stock prices gained initially after the Treasury announcement but later shed most of the gains on concern the money could be better used for lending to boost the economy rather than paying it back to Treasury.

“If they were more concerned about the public, they would keep the cash and start loaning out money,” said Carl Birkelbach, chairman and chief executive of Birkelbach Investment Securities in Chicago.

Treasury Secretary Timothy Geithner told reporters the repayments were an encouraging sign of financial repair but said the United States and other key Group of Eight economies had to stay focused on instituting measures to boost recovery.

MUST KEEP LENDING

Earlier this year U.S. regulators put the 19 largest U.S. banks through “stress tests” to determine how much capital they might need to withstand a worsening recession. Ten of those banks were told to raise more capital, and regulators waited for their plans to do so before approving any bailout repayments.

As a condition of being allowed to repay, banks had to show they could raise money on their own from the private sector both by selling stock and by issuing debt without the help of Federal Deposit Insurance Corp guarantees. The Federal Reserve also had to agree that their capital levels were adequate to support continued lending.

American Express Co (AXP), Bank of New York Mellon Corp (BK), BB&T Corp (BBT), Capital One Financial Corp (COF), Goldman Sachs Group Inc, JPMorgan Chase & Co, Morgan Stanley (MS), Northern Trust Corp (NTRS), State Street Corp (STT) and U.S. Bancorp (USB) all said they had won approval to repay the bailout funds.

In contrast, neither Bank of America Corp (BAC) or Citigroup Inc (C), which each took $45 billion from the government, received a green light to pay back bailout money.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  asset rotation, bailout, bankruptcy, banks, bear market, bonds, bridge loans, capital, cash out, compensation, corporate bonds, debt-ceiling, derivatives, economy, entitlement, equity, FDIC, federal budget, Federal Reserve, financials, govt. stats, growth, income tax, inflation, interest rates, leverage, liquidity, marked to market, MBS, mortgages, Obama, preferred, president, ratings, recession, regional banks, regulation, risk management, securitization, sentiment, subprime, unfunded liabilities, warrants, writedowns | Tagged: axp, bac, bbt, bk, c, cof, gm, gs, jpm, ms, ntrs, stt, usb |

asset rotation, bailout, bankruptcy, banks, bear market, bonds, bridge loans, capital, cash out, compensation, corporate bonds, debt-ceiling, derivatives, economy, entitlement, equity, FDIC, federal budget, Federal Reserve, financials, govt. stats, growth, income tax, inflation, interest rates, leverage, liquidity, marked to market, MBS, mortgages, Obama, preferred, president, ratings, recession, regional banks, regulation, risk management, securitization, sentiment, subprime, unfunded liabilities, warrants, writedowns | Tagged: axp, bac, bbt, bk, c, cof, gm, gs, jpm, ms, ntrs, stt, usb |  Permalink

Permalink

Posted by Jason

Posted by Jason

June 4, 2009

Thu Jun 4, 2009 7:41pm EDT

By Gina Keating and Rachelle Younglai

LOS ANGELES/WASHINGTON (Reuters) – Angelo Mozilo, who built the largest U.S. mortgage lender, was charged with securities fraud and insider trading on Thursday, making him the most prominent defendant so far in investigations into the U.S. subprime mortgage crisis and housing bust.

Mozilo, 70, co-founder of Countrywide Financial Corp (CFC), was accused by the U.S. Securities and Exchange Commission with making more than $139 million in profits in 2006 and 2007 from exercising 5.1 million stock options and selling the underlying shares.

The sales were under four prearranged stock trading plans Mozilo prepared during the time period, the SEC said.

The accusations were made in a civil lawsuit filed by the SEC in Los Angeles on Thursday.

The SEC said that in one instance, the day before he set up a stock trading plan on September 25, 2006, Mozilo sent an email to two Countrywide executives that said: “We are flying blind on how these loans will perform in a stressed environment of higher unemployment, reduced values and slowing home sales.”

Those executives, then Countrywide President David Sambol, 49, and Chief Financial Officer Eric Sieracki, 52, were charged by the SEC with knowingly writing “riskier and riskier” subprime loans that they had a limited ability to sell on the secondary mortgage market.

The SEC said that all three executives failed to tell investors how dependent Countrywide had become on its ability to sell subprime mortgages on the secondary market. All three were accused of hiding from investors the risks they took to win market share.

At one stage, Countrywide was writing almost 1 in 6 of American mortgages. The lawsuit said that by September 2006, Countrywide estimated that it had a 15.7 percent share of the market, up from 11.4 percent at the end of 2003.

“While Countrywide boasted to investors that its market share was increasing, company executives did not disclose that its market share increase came at the expense of prudent underwriting guidelines,” the lawsuit said

Bank of America Corp (BAC) bought Countrywide last July 1 for $2.5 billion, less than a tenth of what it had been worth in early 2007.

“TWO COMPANIES”, EARLY WARNING SIGNS

“This is a tale of two companies,” the SEC’s director of enforcement, Robert Khuzami, told reporters. “One that investors from the outside saw. It was allegedly characterized by prudent business practices and tightly controlled risk.”

“But the real Countrywide, which could only be seen from the inside, was one buckling under the weight of deteriorating mortgages, lax underwriting, and an increasingly suspect business model,” Khuzami said.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  analysts, ARM, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, bubbles, builders, capital, civil penalties, compensation, contrarian, economy, entitlement, equity, fair value accounting, financials, foreclosure, fraud, GDP, Great Depression, growth, housing, income tax, inflation, insider trading, interest only, interest rates, lawsuits, lending standards, leverage, liquidity, loan to value, mortgages, prime mortgage, ratings, real returns, recession, regulation, risk management, SEC, securitization, sentiment, short-selling, subprime, unemployment, unfunded liabilities, writedowns | Tagged: bac, cfc |

analysts, ARM, bailout, bank failure, bankruptcy, banks, bear market, behavioral science, bubbles, builders, capital, civil penalties, compensation, contrarian, economy, entitlement, equity, fair value accounting, financials, foreclosure, fraud, GDP, Great Depression, growth, housing, income tax, inflation, insider trading, interest only, interest rates, lawsuits, lending standards, leverage, liquidity, loan to value, mortgages, prime mortgage, ratings, real returns, recession, regulation, risk management, SEC, securitization, sentiment, short-selling, subprime, unemployment, unfunded liabilities, writedowns | Tagged: bac, cfc |  Permalink

Permalink

Posted by Jason

Posted by Jason

June 2, 2009

Tuesday June 2, 2009, 1:19 pm EDT

NEW YORK (Reuters) – U.S. distressed debt, among the hardest hit asset classes last year, has become the best, with returns of 39.5 percent year to date as risk appetite improves, Bank of America Merrill Lynch said.

For the month of May, distressed debt was second only to emerging market equities after returning 25.4 percent, Bank of America Merrill said in a research note late on Monday.

Distressed issuers are those whose bond spreads trade at or above 1,000 basis points over comparable Treasuries.

Distressed issuers drove 95 percent of the strong performance of the U S. high-yield corporate bond market in May as a resurgence of new debt sales improved sentiment, the report said.

“Some deeply distressed issuers were able to access new issue markets and enjoyed significant improvements in pricing of their existing bonds as a result,” said Oleg Melentyev, lead author of the report.

Companies including Ford Motor Co’s (F) finance arm, Harrah’s Entertainment and MGM Mirage (MGM) sold more than $23 billion in junk bonds in May, the most since the credit crisis started in mid-2007, according to Thomson Reuters data.

The high-yield cash market outperformed high-yield derivatives by 2 percentage points in May, the report said. The main index of high-yield credit default swaps returned 5.1 percent while Merrill Lynch’s high-yield Master II index returned 7.1 percent.

The junk bond market has retraced all of the losses it sustained in the financial meltdown late last year, Melentyev said.

(Reporting by Tom Ryan; Additional reporting by Dena Aubin; Editing by James Dalgleish)

Leave a Comment » |

Leave a Comment » |  asset rotation, bear market, bonds, capital, corporate bonds, derivatives, dividend yield, economy, equity, growth, high-yield, interest rates, liquidity, real returns, relative strength, risk management, sentiment, swaps, Treasury bonds | Tagged: bac, f, mgm |

asset rotation, bear market, bonds, capital, corporate bonds, derivatives, dividend yield, economy, equity, growth, high-yield, interest rates, liquidity, real returns, relative strength, risk management, sentiment, swaps, Treasury bonds | Tagged: bac, f, mgm |  Permalink

Permalink

Posted by Jason

Posted by Jason

June 1, 2009

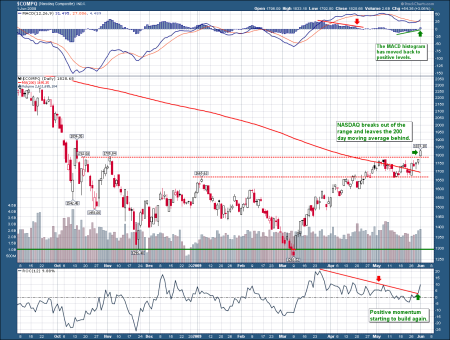

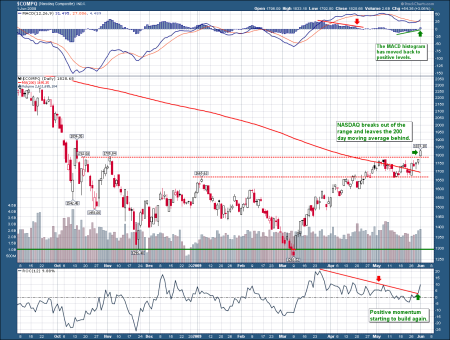

The NASDAQ leads the market higher; leaves the 200 day behind

The S&P 500 accomplished something today, trading above the 200 day simple moving average for the first time in over a year. It was last call in May of 2008 at the 200 day for the SPX before dropping over 50% to the lows of this past March (the SPX hasn’t actually closed above this trend line since late 2007). Today also marks a new high for 2009, some 42% above those March lows in less than three months! Year-to-date the SPX has gained just over 4%.

The NASDAQ is the real star leading the markets higher and breaking free from the recent consolidation range. The NASDAQ is also some 8% above its 200 day simple moving average and almost 10% above the early January highs. Sitting on a year-to-date gain of 16% and almost 45% above the March lows, large cap techs are showing investors’ renewed interest in risk.

At this point, we are exiting the position in SH with a small loss on this renewed strength (see Security Growth for details).

Leave a Comment » |

Leave a Comment » |  200 day MA, asset rotation, bear market, capital, charts, growth, real returns, recession, relative strength, S&P 500, tech stocks | Tagged: comp, sh, spx |

200 day MA, asset rotation, bear market, capital, charts, growth, real returns, recession, relative strength, S&P 500, tech stocks | Tagged: comp, sh, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

May 8, 2009

Results show 10 big banks need $75 billion in new capital; hope rises for economy’s recovery

Daniel Wagner and Jeannine Aversa, AP Business Writers

Friday May 8, 2009, 1:09 am EDT

WASHINGTON (AP) — Government exams of the biggest U.S. banks have helped lift a cloud of uncertainty that has hung over the economy.

The so-called stress tests — a key Obama administration effort to boost confidence in the financial system — showed nine of the 19 biggest banks have enough capital to withstand a deeper recession. Ten must raise a total of $75 billion in new capital to withstand possible future losses.

“The publication of the stress tests simply cleared the air of uncertainty,” said Allen Sinai, chief global economist at Decision Economics. “The results were not scary at all.”

He said it will take a long time for the banks to resume normal lending. But the test results didn’t alter his prediction that economy is headed for a recovery in October or November.

A key indicator of economic health will be released Friday morning, when the government announces how many more jobs were lost in April and how high the unemployment rate rose.

The stress tests have been criticized as a confidence-building exercise whose relatively rosy outcome was inevitable. But the information, which leaked out all week, was enough to cheer investors. They pushed bank stocks higher Wednesday, and rallied again in after-hours trading late Thursday once the results had been released.

Among the 10 banks that need to raise more capital, Bank of America Corp. (BAC) needs by far the most — $33.9 billion. Wells Fargo & Co. (WFC) needs $13.7 billion, GMAC LLC $11.5 billion, Citigroup Inc. (C) $5.5 billion and Morgan Stanley (MS) $1.8 billion.

The five other firms found to need more of a capital cushion are all regional banks — Regions Financial Corp. (RF) of Birmingham, Alabama; SunTrust Banks Inc. (STI) of Atlanta; KeyCorp (KEY) of Cleveland; Fifth Third Bancorp (FITB) of Cincinnati; and PNC Financial Services Group Inc. (PNC) of Pittsburgh.

The banks will have until June 8 to develop a plan and have it approved by their regulators. If they can’t raise the money on their own, the government said it’s prepared to dip further into its bailout fund.

The stress tests are a big part of the Obama administration’s plan to fortify the financial system. As home prices fell and foreclosures increased, banks took huge hits on mortgages and mortgage-related securities they were holding.

The government hopes the stress tests will restore investors’ confidence that not all banks are weak, and that even those that are can be strengthened. They have said none of the banks will be allowed to fail.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  analysts, auto-leasing, bailout, bank failure, bankruptcy, banks, bear market, bridge loans, capital, credit cards, debt-ceiling, derivatives, drawdown, economy, equity, federal budget, Federal Reserve, financials, foreclosure, govt. stats, growth, housing, lending standards, leverage, liquidity, loan to value, marked to market, MBS, mortgages, Obama, president, prime mortgage, ratings, recession, regional banks, regulation, relative strength, risk management, sentiment, subprime, unemployment, unfunded liabilities, writedowns | Tagged: axp, bac, c, cof, fitb, gs, jpm, key, met, ms, pnc, rf, sti, stt, wfc |

analysts, auto-leasing, bailout, bank failure, bankruptcy, banks, bear market, bridge loans, capital, credit cards, debt-ceiling, derivatives, drawdown, economy, equity, federal budget, Federal Reserve, financials, foreclosure, govt. stats, growth, housing, lending standards, leverage, liquidity, loan to value, marked to market, MBS, mortgages, Obama, president, prime mortgage, ratings, recession, regional banks, regulation, relative strength, risk management, sentiment, subprime, unemployment, unfunded liabilities, writedowns | Tagged: axp, bac, c, cof, fitb, gs, jpm, key, met, ms, pnc, rf, sti, stt, wfc |  Permalink

Permalink

Posted by Jason

Posted by Jason

May 5, 2009

Tue May 5, 2009 8:01pm EDT

By Kevin Krolicki

DETROIT (Reuters) – General Motors Corp (GM) on Tuesday detailed plans to all but wipe out the holdings of remaining shareholders by issuing up to 60 billion new shares in a bid to pay off debt to the U.S. government, bondholders and the United Auto Workers union.

The unusual plan, which was detailed in a filing with U.S. securities regulators, would only need the approval of the U.S. Treasury to proceed since the U.S. government would be the majority shareholder of a new GM, the company said.

The flood of new stock issuance that could be unleashed has been widely expected by analysts who have long warned that GM’s shares could be worthless whether the company restructures out of court or in bankruptcy.

The debt-for-equity exchanges detailed in the filing with the Securities and Exchange Commission would leave GM’s stock investors with just 1 percent of the equity in a restructured automaker, ending a long run when the Dow component was seen as a bellwether for the strength of the broader U.S. economy.

GM shares closed on Tuesday at $1.85 on the New York Stock Exchange. The stock would be worth just over 1 cent if the first phase of GM’s restructuring moves forward as described.

Once GM has issued new shares to pay off its debt to the U.S. government, bondholders and its major union, it said it would then undertake a 1-for-100 reverse stock split.

Such a move would take the nominal value of the stock back to near where it had been before the flood of new shares. But in the process, GM’s existing shareholders would see their stake in the 100-year-old automaker all but wiped out.

Read the rest of this entry »

Leave a Comment » |

Leave a Comment » |  auto-leasing, bailout, bankruptcy, bear market, bonds, bridge loans, buy and hold, capital, compensation, conservation, corporate bonds, debt-ceiling, efficiency, entitlement, gasoline prices, global warming, govt. stats, hybrid electric vehicle (HEV), industrialization, Obama, peak oil, PHEV, pollution, recession, regulation, risk management, sentiment, unemployment, unfunded liabilities, used car values, writedowns | Tagged: gm |

auto-leasing, bailout, bankruptcy, bear market, bonds, bridge loans, buy and hold, capital, compensation, conservation, corporate bonds, debt-ceiling, efficiency, entitlement, gasoline prices, global warming, govt. stats, hybrid electric vehicle (HEV), industrialization, Obama, peak oil, PHEV, pollution, recession, regulation, risk management, sentiment, unemployment, unfunded liabilities, used car values, writedowns | Tagged: gm |  Permalink

Permalink

Posted by Jason

Posted by Jason

April 14, 2009

An update on the SPX chart today to show the market finding resistance near previous highs. We are adding a new indicator to the top of the chart, the MACD. The negative divergence in the MACD histogram reinforces the strength of this resistance as the market advance begins to stall. Finally, we have a short term reversal pattern showing in the candlesticks as an Evening Doji Star has formed over the last 3 trading days. Taken together, it looks as if profit taking may have already started.

The NASDAQ chart shows similar resistance being met at the Jan highs with negative divergences in the MACD histogram and the Rate of Change indicator which is approaching the zero line. Both of these confirm the loss of momentum as the market approaches resistance.

Exactly the opposite looks to be developing in the ProShares Short S&P 500 Fund ETF (SH) as positive divergences are present with the price firming near support. Hedging long exposure here and/or taking profits looks like a good idea. It’s still a bear market rally at this point.

Leave a Comment » |

Leave a Comment » |  200 day MA, 50 day MA, asset rotation, bear market, buy and hold, capital, cash out, charts, contrarian, equity, Exchange Traded Funds/Notes, growth, real returns, relative strength, risk management, S&P 500, short ETFs | Tagged: comp, sh, spx |

200 day MA, 50 day MA, asset rotation, bear market, buy and hold, capital, cash out, charts, contrarian, equity, Exchange Traded Funds/Notes, growth, real returns, relative strength, risk management, S&P 500, short ETFs | Tagged: comp, sh, spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

April 2, 2009

We have a lot to show, so we’ll keep each one short and sweet.

First, an update on the SPX battle with the 50 day. The bear trap looks to be pretty solid with assistance from the Feds. How much backing and filling needs done is still up for debate. We have added a new indicator to the bottom of the chart this time, the daily 13/34 exponential moving average indicator. We have it set on a favorite parameter of John Murphy at Stockcharts.com that we have referenced previously in Is it really 2001 again? Look for further reference in the charts below. This indicator on the daily chart is more of a leading indicator (subject to some whipsaw) and becomes more valuable when combined with the medium and long period charts. The daily indicator has turned positive (above zero) and has held positive ground for the first time since early in the year. This is the most positive showing for this indicator since April/May of 2008.

Here is a weekly shot of the same indicator. Even with this indicator still deeply in negative territory (below zero) a clear positive trend change is visible. This is confirmed by the SPX moving above the 13 week exponential moving average, which drags the indicator higher. These are also the first positive developments in this indicator since April/May of 2008.

Finally we have the monthly chart featuring the indicators referenced previously (MACD, RSI, ROC) plus an overlay of the 20 month Bollinger Bands set to two standard deviations. This shows all of these indicators to have been severely stretched, yet showing signs of recovery. The MACD histogram is now climbing for two months in a row and the RSI is closing in on 30, which marks the top of oversold territory. The ROC has at least ceased its vertical drop and the Bollinger Bands are finally well below the current price as opposed to being violently penetrated to the downside. This at least shows stabilization, with potential being revealed by the shorter periods.

Leave a Comment » |

Leave a Comment » |  200 day MA, 50 day MA, asset rotation, bear market, buy and hold, capital, charts, economy, equity, fair value accounting, Federal Reserve, fiscal policy, growth, lending standards, liquidity, marked to market, real returns, recession, regulation, relative strength, risk management, S&P 500, SEC, sentiment | Tagged: spx |

200 day MA, 50 day MA, asset rotation, bear market, buy and hold, capital, charts, economy, equity, fair value accounting, Federal Reserve, fiscal policy, growth, lending standards, liquidity, marked to market, real returns, recession, regulation, relative strength, risk management, S&P 500, SEC, sentiment | Tagged: spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

March 30, 2009

The SPX only stayed above the 50 day simple moving average this time for 5 days. At the turn of the year, it at least managed 7. The 2002 lows are crucial support to test the will of new buyers. If they fail to hold, the 741 level will serve as the canary to warn of a possible complete retest of the March lows.

So far, we have only another headfake to the upside created by jawboning from the Feds. We still believe this is part of a bottoming process, but we need more honest buying (not short covering) to confirm the lows are already in.

Leave a Comment » |

Leave a Comment » |  401k, 50 day MA, asset rotation, bear market, capital, charts, demographics, drawdown, economy, equity, Federal Reserve, growth, real returns, recession, relative strength, risk management, S&P 500, sentiment | Tagged: spx |

401k, 50 day MA, asset rotation, bear market, capital, charts, demographics, drawdown, economy, equity, Federal Reserve, growth, real returns, recession, relative strength, risk management, S&P 500, sentiment | Tagged: spx |  Permalink

Permalink

Posted by Jason

Posted by Jason

Posted by Jason

Posted by Jason